[ad_1]

The GBP/USD price entered the new week’s trading to test a key level of support on the charts with only limited recovery prospects after a long string of losses, while more declines are still possible due to the increasingly aggressive monetary policy stance of the US Federal Reserve. The GBP/USD pair collapsed to the 1.2696 support level, the lowest for the currency pair since September 2020.

All in all, sterling has faltered since the start of last week, but fell sharply on Friday as the dollar rose against almost everyone else on hawkish sentiment on the part of Fed policy makers, and with the rug pulled from under sterling after a terrible batch of UK economic numbers. The dollar rose almost across the board after Federal Reserve Chair Jerome Powell effectively endorsed the market’s latest bet that the bank would likely go ahead with a larger-than-usual 50 basis point increase in the US interest rate at its next meeting in May.

Commenting on this, Paul Robson, FX Analyst at Natwest Markets says, “It is worth noting that this week saw both the euro and the Chinese yuan weaken against the US dollar, with both dollar pairs being the mainstays of the currency.” This indicates that divergence in monetary policy is dominant. So it’s a step that we think should go forward.

Dollar exchange rates rose broadly last week after Chairman Powell’s comments Thursday at the International Monetary Fund’s (IMF) spring conference left little doubt that the bank is now focused on normalizing its monetary policy settings while ruling out everything else in its fight to bring down economic inflation. for the United States. Jerome Powell stated, “There is something about the idea of foreloading, i.e. a place where one sees fit pointing in the direction of 50 bps on the table.” And “we make these decisions in the meeting and we will make them meet in the meeting, but I would say that 50 basis points will be on the table in the May meeting.” .

On the Fed’s policy outlook, Powell added, “The actual peak could be in March but we don’t know so we’re not going to rely on it and we’re also not going to rely on help from a supply-side recovery. And if we get that, that would be great. But we will really focus on raising US interest rates and quickly get to more neutral levels and then really tight if that turns out to be appropriate.”

The Fed’s tougher policy stance had already put pressure on the pound-dollar rate on Friday even before UK retail sales figures and the PMI acquitted the Bank of England (BoE) for its recent cautious language on UK interest rate expectations.

“The sharp drop in UK retail sales in March is the first definitive evidence that households are struggling to sustain their spending while their real disposable income is declining,” says Samuel Tombs, chief UK economist at Pantheon Macroeconomics.

Accordingly, the MPC will tread very carefully over the coming months. Indeed, last week’s data certainly eliminated the chances of a 50 basis point rate hike next month; We are still looking for a 25bp increase. The BoE has repeatedly said since February that the economic impact of commodity pressure on income may reduce the extent to which interest rate hikes are needed, but markets continued to bet that the bank rate would rise from the current 0.75% to more. from 2% by the end of the year.

We expect the policy divergence between the BoE and the Federal Reserve to become more pronounced in the coming months. So Lee Hardman, currency strategist at MUFG, says building evidence of a sharper slowdown in the UK economy will make the BoE cautious.

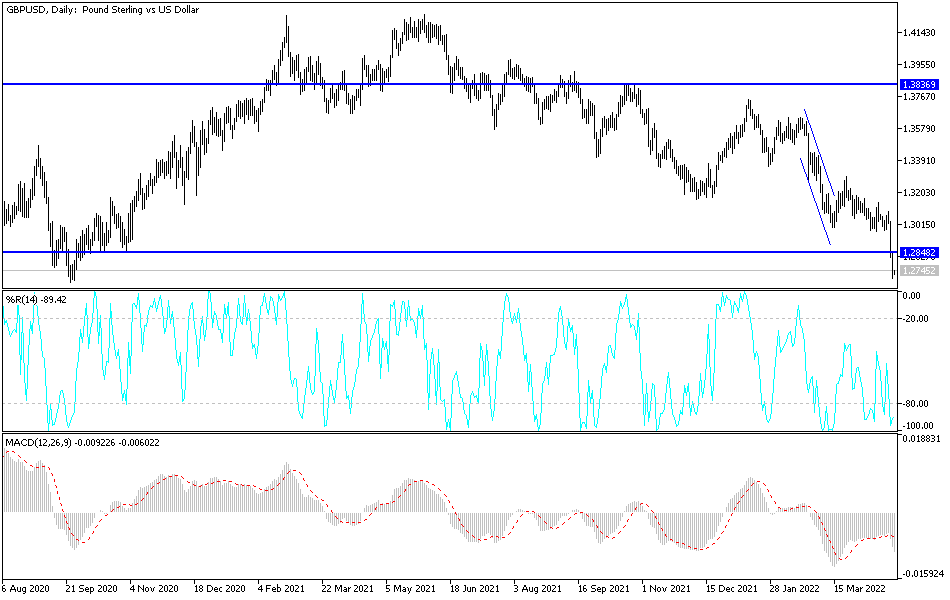

The stability of the GBP/USD currency pair remains below the 1.3000 psychological level that supports the downside trend, and I’ve said a lot that a breakdown will support more selling operations. Therefore, the pair moved towards stronger support levels, and the pair reached the levels that we currently expected, the closest targets being 1.2680, 1.2590 and 1.2500. It is sufficient to push the technical indicators towards strong oversold levels.

On the other hand, there will be no chance for the currency pair to rebound higher without breaching the resistance levels 1.3000 and 1.3185. So far the general trend for the GBP/USD pair is down.

Today from Britain, the public sector net borrowing will be announced, and from the United States, the durable goods orders, the US consumer confidence and the US new home sales will be announced.

[ad_2]