I do believe that given enough time, we could go back to the ₹77 level.

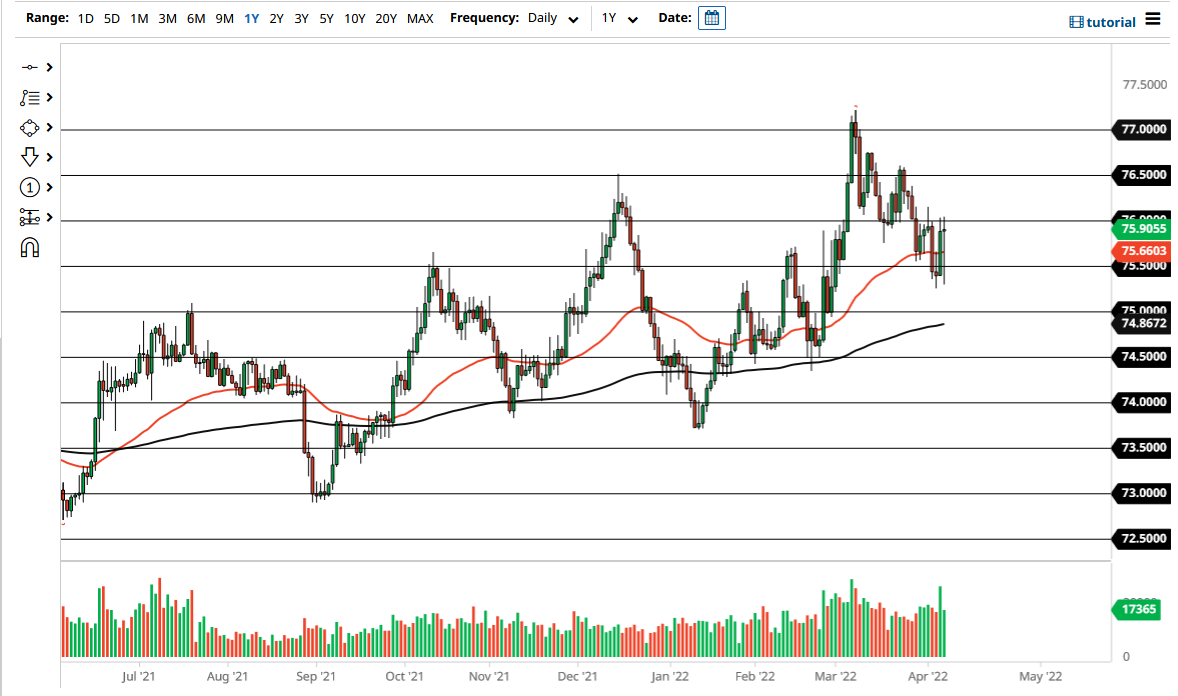

The US dollar initially fell against the Indian rupee during the trading session on Thursday but found support near the ₹75.50 level as we have seen multiple days in a row. Ultimately, this is a market that has been in an uptrend previously but then pulled back to show signs of exhaustion. Now we are dancing around the same region for the last several days, which suggests that we are trying to build up a bit of a base for continuation.

It is worth noting that the 50 Day EMA is slicing right through the middle of the candlestick for the Thursday session, which ended up being a hammer. The ₹76 level is at the top of a hammer, and it is an area that has been difficult to break above recently. By breaking above there, it allows the US dollar to continue going higher, with an eye on the ₹76.25 level, and then the ₹76.50 level. The market continues to favor the greenback overall, although the pullback was somewhat significant.

With interest rates rising in the United States, that does put a bit of bullish pressure on the greenback, and you see that in multiple markets, not just this one. That being said, the market is likely to see a significant amount of noise overall, as the US dollar is not only seeing higher interest rates but it is also used as a safety instrument, as emerging market currencies are considered to be further out on the risk spectrum. That is especially true with the Indian rupee, which needs global growth to really get moving.

On the other side of the trade, if we were to break down below the hammer during the trading session on a daily close for Friday, then it could be a sign that we are going to go looking to the ₹75 area, which the 200 Day EMA is racing towards. Nonetheless, things look bullish at the moment, or at the very least that we are trying to build a bit of consolidation. Because of this, the market favors a breakout soon, and I certainly would be willing to jump on that breakout when it happens. This is especially true if it is to the upside. I do believe that given enough time, we could go back to the ₹77 level.