This market will continue to be very noisy, and therefore the volatility should be rather significant.

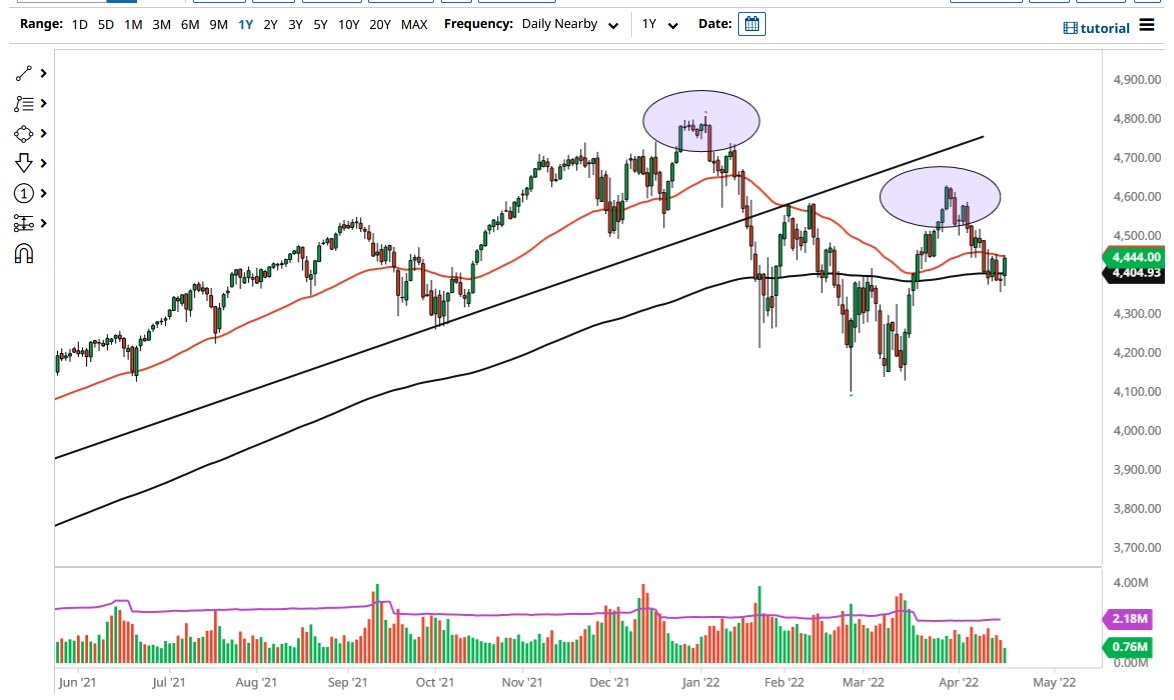

The S&P 500 initially dipped on Tuesday, but then turned around to show signs of strength. The 50 Day EMA is currently being threatened, and the futures market is trying to break above there, perhaps reaching the 4500 level. The 4500 level of course is an area that has a certain amount of psychology attached to it, so it does make sense that we would at least try to get there. That being said, the 4500 level is a large, round, psychologically significant figure and it could offer quite a bit of psychological resistance.

The market tends to see the area between the 200 Day EMA and the 50 Day EMA as a major barrier, so if we were to break above or below, that could be thought of as a potential signal. That being said, one of the biggest problems that the S&P 500 futures market faces right now is whether or not the Federal Reserve is going to continue to be extraordinarily hawkish. With inflation running as hot as it has in the last 40 years, it is possible that the market will believe that the Federal Reserve is going to ignore it, and perhaps not hike as many times as they said, but the reality is that the inflationary numbers are so strong that it is difficult to imagine a scenario where they do not raise rates.

The hammer from the Monday session being broken to the downside would open up the possibility of a much bigger drop to the downside, perhaps sending the S&P 500 futures down to the 4300 level, possibly even down to the 4200 level. Both of those areas could offer a certain amount of support, but I do not necessarily think that they are necessarily overly important.

One thing that is worth paying attention to is that if we break above the 4500 level, then it is possible that the market could go to the 4600 level. Breaking above there then kicks off a major “inverted head and shoulders”, which of course is a very bullish scenario, and could send this market much higher. In general, this is a market that I think will continue to be very noisy, and therefore the volatility should be rather significant. With that being the case, you need to trade in relatively small positions.