Although I think that we may continue to see buyers, it is going to continue to be very noisy and difficult.

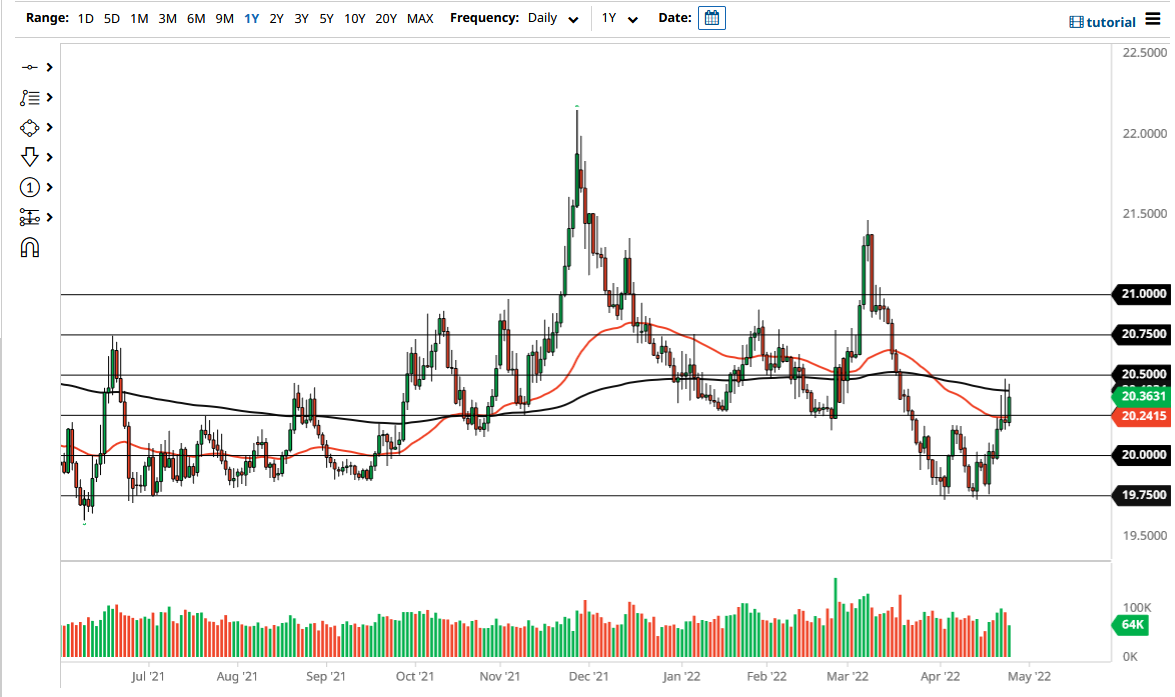

The US dollar rallied on Tuesday to test the 200-day EMA against the Mexican peso. After forming a shooting star both last Friday and yesterday, the Tuesday session shows just how stubborn this market has been breaking down, and it looks like we are going to continue to see an attempt to break to the upside. Breaking above the 20.50 level would show an extreme amount of bullish pressure.

Latin American currencies can give great price movements.

Trade them with our featured broker.

Trade Now !

Underneath, we have the 50-day EMA which is currently at the 20.2427 level and rising. That could be thought of as an area of support, but currently, we are essentially “stuck” between the 50-day EMA and the 200-day EMA, which typically means that there is a certain amount of pressure being built into the market. At this point, if we were to break out to the upside, it could show extreme US dollar strength, as the breaking to the upside of two shooting stars and the 200-day EMA is a “triple strong” type of signal.

If we were to turn around and break down below the shooting stars from the last couple of days, then we could break down to reach the 20 level. I do not necessarily think that is likely, but if it were to happen, then it is obvious that the Mexican peso would keep up its strength, and we could go looking to reach the 19.75 level below.

When you look at the chart, you can also see that there was a big “W pattern” that we have recently broken out of, which measures for a move to the 20.75 level. That is my target at the moment, but I also recognize that there is a lot of noise between here and there that we would have to chew through in order to go higher, so keep that in mind as well. In other words, although I think that we may continue to see buyers, it is going to continue to be very noisy and difficult, so this is not to say that it is going to be easy to get there. Crude oil does have a bit of an effect on this market, but quite frankly with the Federal Reserve looking as hawkish as it does, and all of the fear around the world, the US dollar should continue to attract a lot of inflows.