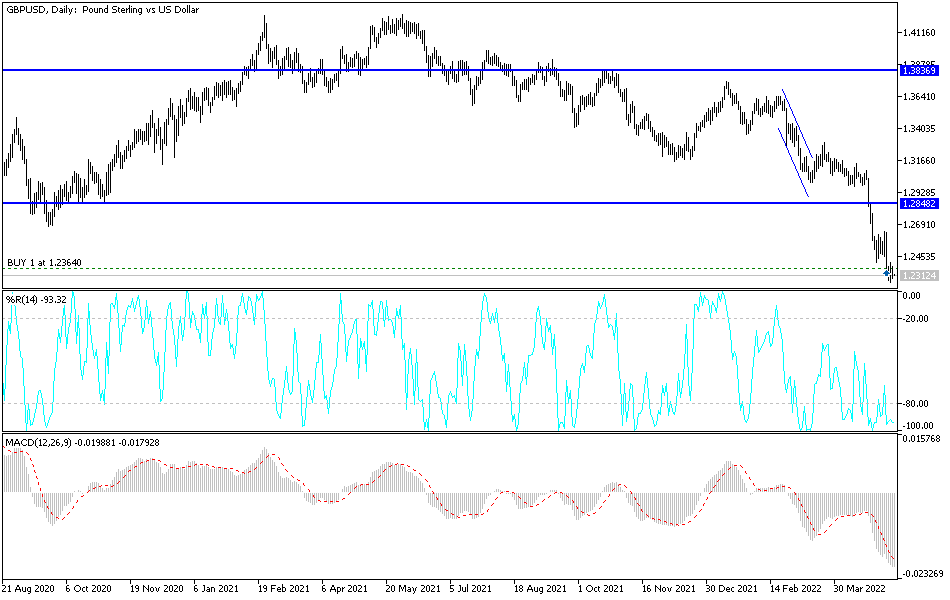

For four consecutive trading sessions, the price of the GBP/USD currency pair is stabilizing amid a strong and sharp bearish momentum that pushed it towards its lowest level in two years. It reached the 1.2260 support level, before settling around the 1.2315 level at the time of writing the analysis. The sterling suffered a major setback due to the pessimism that culminated in the recent indications of the Bank of England after it raised interest rates after raising the US interest rate as well.

The dollar will turn its tail around the middle of the year, analysts at Westpac say, at which point sterling under pressure could make a more sustainable recovery. All in all, the GBP/USD exchange rate has come under great pressure in recent days as markets pushed the pair to a 2-year low following the Bank of England monetary policy decision in May.

The exchange rate has been declining since May 2021 when a broader rally for the dollar began and eventually continued to this day, hitting a new 19-year high on May 9. Thus, it is the overriding strength of the dollar that will need to be stopped and forced to retreat if it is the sterling that will make a more sustainable recovery.

The dollar’s price rose as a result of a combination of the superior US economic performance, expectations linked to higher US interest rates by the Federal Reserve, and a significant decline in global investor sentiment.

The Fed is draining liquidity from the global economy, while grappling with growth concerns over China’s response to COVID-19 and the war in Ukraine. This background is very bullish for the countercyclical dollar.

The US Dollar Index (DXY), a measure of the broader dollar’s value based on key dollar exchange rates, rose to its highest level since 2003 on May 09 when it reached 104.18.

The two European currencies are expected to rebound against the dollar by about 3% through the end of the year, a view based on the dissipation of risks related to the regional outlook and the expansion of the global recovery. The assumption is that the regional risks posed by the war in Ukraine will fade as a major concern for markets. Westpac forecast that the euro-dollar exchange rate will end at 1.09 in 2022 and rise to 1.15 through 2023. Meanwhile, the GBP/USD exchange rate forecast is expected to rise to 1.27 by the end of 2022 before extending to 1.34 by the end of 2023.

According to the technical analysis of the pair: So far, the general trend of the GBP/USD currency pair and stability around and below the 1.2300 support level supports a stronger control of the bears. The recent losses pushed the technical indicators towards oversold levels, but the continuation of pressure factors did not deter the bears from stopping It increased expectations by moving towards the next psychological support 1.2000, its lowest since May 2020. On the other hand, there will be no reversal of the current general trend, according to the performance on the daily chart, without moving towards the psychological resistance level 1.3000. Today, the currency pair will be affected by the announcement of important US inflation figures, amid the economic calendar devoid of British economic data.