Any opportunity to short this market on exhaustion will be taken.

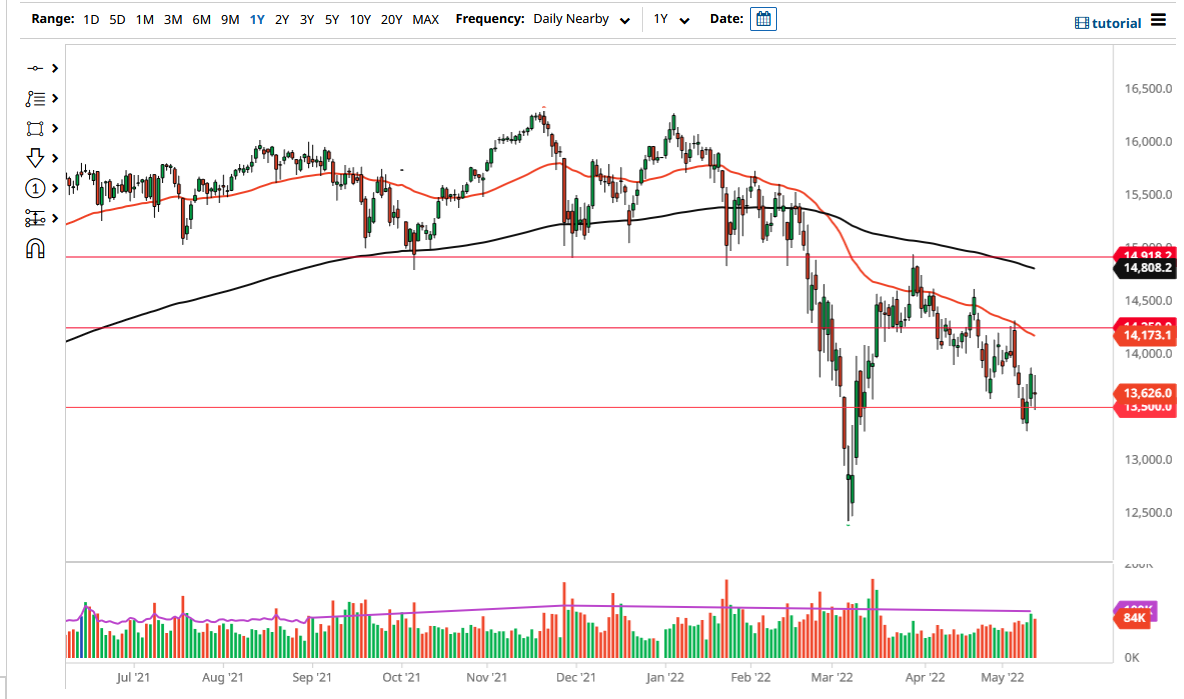

The German index has gone back and forth during the bulk of the trading session on Thursday, as we continue to see a lot of questions asked about the global economy. The futures markets dip down to the 13,500 level where you would anticipate a little bit of psychological support and then bounced back to finish the day somewhat unchanged. This does suggest that perhaps we are going to get a little bit of a rally, but that rally is not something I am necessarily looking to buy into.

The €13,750 level above is a bit of a barrier, just as it had previously been supported. The 50 Day EMA is above there and hanging right around the €14,173 level. It is drifting lower, and it has been dynamic resistance more than once. Because of this, I think that the first signs of exhaustion will more likely than not get sold into.

Keep in mind that there is a lot of concern about the global markets and global economies around the world so it is difficult to imagine a scenario where you want to jump in and start buying an index. That being said, we may get a little bit of a rally heading into the weekend for a simple short covering. It is not until we break above the 50 Day EMA and even the €14,500 level that I would be a buyer. After that, then the €15,000 level would be the next target. It is not until we break above there that I would be comfortable going long because I think there are far too many potential problems out there to derail any type of “risk-on rally” that we would see in any of the indices, let alone the DAX.

Keep in mind that the European Union has been showing less than attractive economic figures, and of course, as the world runs towards the US dollar for safety, it does make sense that we continue to see a lot of fear when it comes to the markets. Interest rates in Germany reflect serious concern about the overall outlook for the German economy, as well as the rest of the European Union. The DAX is full of major exporters, and therefore the destruction that we see globally is going to be felt in this market. Any opportunity to short this market on exhaustion will be taken.