The sharp pessimistic view on the part of the Bank of England, the fears of the impact of the Russian gas cut on Britain, and an expected path for a strong tightening of the US Federal Reserve’s policy, increased the selling of the GBP/USD currency pair to the 1.2155 support level. This is the lowest in two years and closed last week’s exciting trading stable around the level of 1.2258, amid strong control of the bears continuing.

The Pound benefited from the Euro sell-off and regained its recent losses caused by the reduction in interest rate hike expectations from the Bank of England. The Bank of England rate hike expectations have been dampened following the May monetary policy update as it raised near-term inflation expectations but lowered growth and long-term inflation expectations. We reported at the time that the BoE could be the first major central bank to explain the difficult reality facing advanced economies where growth is low, and inflation is rising and that what happened to the British pound could happen to the future of other currencies very soon.

Commenting on the factors influencing the currency pair, says Ulrich Lochtmann, FX and Commodity Research Analyst at Commerzbank, “The Bank of England recently forecast a prolonged period of stagflation in Britain. So many thought that British central bankers were pessimistic as a result. I think the recent price action shows that the BoE’s view will soon become the view of the majority among market participants, and not just in relation to the UK! .

Essentially, investors can also recognize that the UK is not necessarily in a materially worse position than the Eurozone in terms of inflation and growth risks. Indeed, while the Bank of England seems certain to offer more interest rate hikes in the market, the ECB sees an opportunity to normalize rates. The UK’s gas dynamics also appear to be in a stronger position than the Eurozone due to the UK’s ability to process LNG off ships and turn it into gas, before sending it via a pipeline to Europe.

We note reports that UK gas prices fell the next day earlier in the week amid a glut of gas from LNG sources waiting to be exported to Europe.

“Natural gas prices have jumped as a result, and while prices have jumped in the UK as well, prices have been lower in the UK lately,” says MUFG Halpenny. Since the beginning of April, prices in Europe have fallen by 10% but during the same period, prices in the UK have fallen by 40%.”

The EUR/USD parity could drive the GBP up even more. Analysts warn that the euro could weaken further if Russia puts more pressure on European gas supplies, an outcome increasingly likely given the abject failure of Russian forces to make progress in eastern Ukraine. Rabobank tells clients that they now expect a strong chance of a recession in the Eurozone at the end of this year.

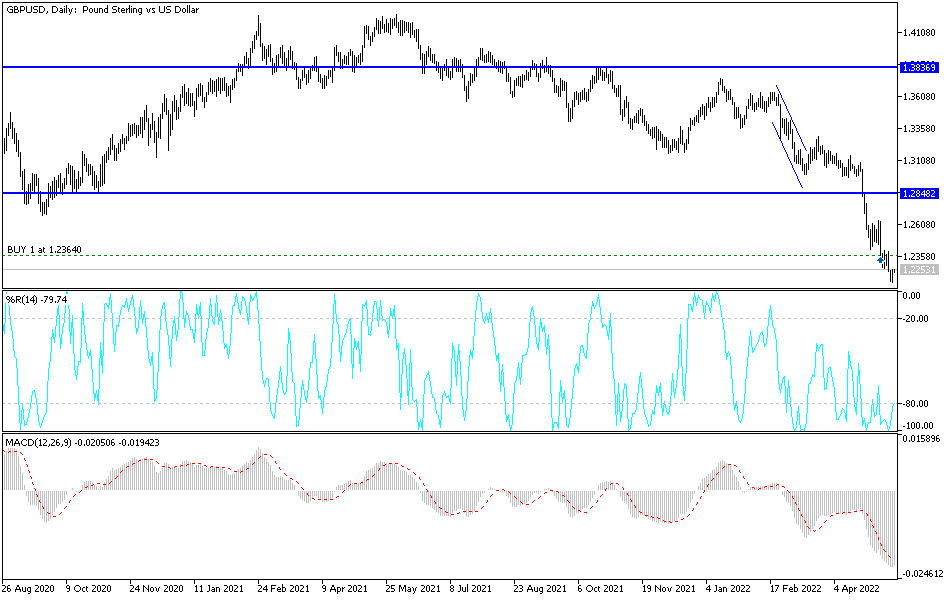

According to the technical analysis of the pair: The general trend of the GBP/USD currency pair is still bearish, and there will be no change in the trend without a change in tone and the Bank of England’s view towards some optimism. Both the Federal Reserve and the Bank of England are in one path towards more rate hikes during the year 2022. On the daily chart, the pair’s recent losses have moved the technical indicators towards oversold levels. With continued weakness factors, forex investors may not find an opportunity to think of buying now and breaking the resistance 1.2850 is important to break the current sharp bearish channel.

The sterling-dollar pair may test the psychological support 1.2000 as soon as the 1.2120 support is breached. Today’s sterling will be affected by the reaction from hearing the Bank of England report.