If you are a shorter-term futures trader like I am, fade rallies as they will offer plenty of opportunities.

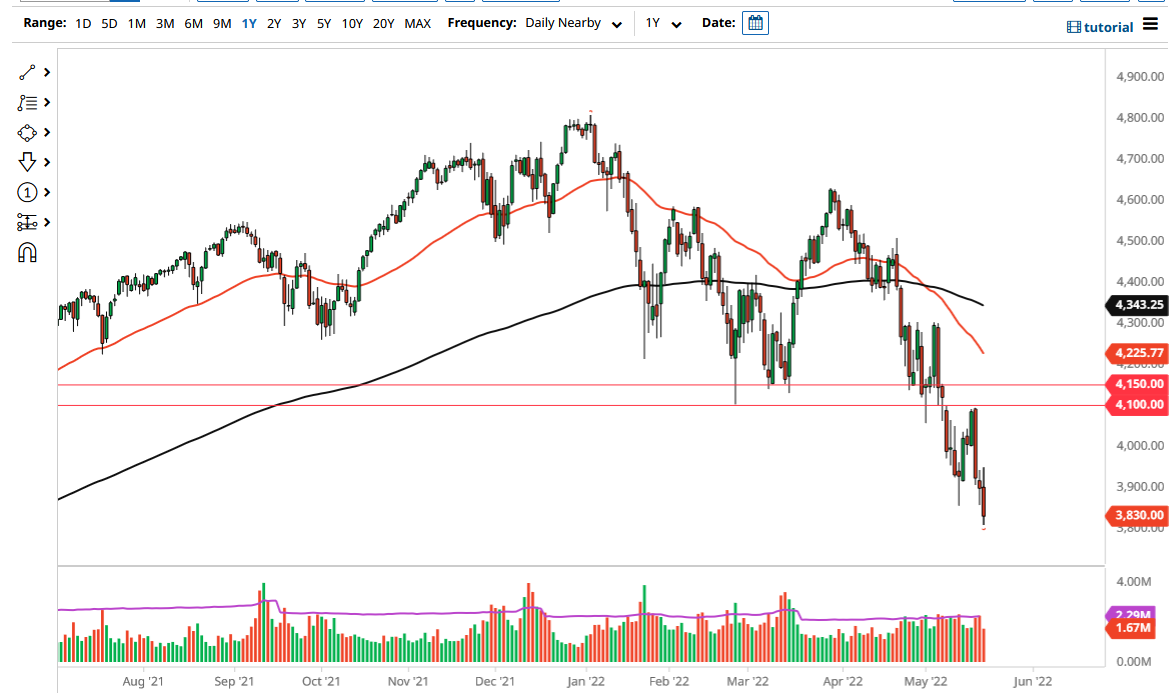

The S&P 500 initially rallied during the futures markets but fell apart quite rapidly. In fact, we have broken a short-term “double bottom”, and it suggests that we have further downward pressure. Beyond all of that, we had a massive options expiration during the trading session, and I think it is only a matter of time before we see even further downward pressure.

At this point, any rally will more than likely be sold into at the first signs of exhaustion, because there are far too many things out there working against the risk appetite, and it is likely that the sellers will continue to jump on the first signs of hope. At this point, it looks like the 3800 level continues to offer short-term support, but it is likely that we could break down below there.

Looking at this chart, you can see that we are crashing rather hard, and for what it is worth, the S&P 500 officially entered a “bear market”, thereby causing a lot of headline noise. Ultimately, this is a market that is going to continue to see a lot of fear, as the Federal Reserve is relentless in its decision to tighten monetary policy so it can fight inflation. That is horrible for risk assets, and you are seeing Wall Street come to grips with the fact that the Federal Reserve may not prop it up at this point. Ultimately, fading rallies will continue to be the way going forward, at least at the first signs of exhaustion.

Keep in the back of your mind that the market will eventually offer a huge opportunity for a longer-term “buy-and-hold” type of situation. Ultimately, this is a situation where eventually the Federal Reserve will step in, but we are nowhere near that happening, so we need to be very cautious in the short term. Ultimately, this is a market that will offer quite a bit of opportunity, but if you are a “long-only investor” you have quite some time before you need to put any money to work. If you are a shorter-term futures trader like I am, fade rallies as they will offer plenty of opportunities. Position sizing matters of course, because in the midst of the bear market, you get some of the most vicious rallies occasionally.