The pound against the dollar rebounded from its earlier losses late last week but faltered again in weak holiday trading on Friday after the US non-farm payrolls and services PMI reports for May provided stimulus to the Federal Reserve. This seemed to have become more hardline in recent days. The gains of the GBP/USD pair did not exceed the resistance level of 1.2589 and returned to stability downwardly around the 1.2500 level at the time of writing the analysis, which confirms the continuation of pressure factors on the pound.

The GBP/USD pair returned to negative influence after the US data seemed to call on the Federal Reserve to consider a faster pace of US interest rate hikes in the coming months. The next FOMC meetings will need to see employment gains run well below the current pace to prevent further tightening in labor markets that the Fed wants to avoid.

Official measures of wage growth in the United States eased slightly in May with the pace of job growth, although it may not have been enough to change much for the Fed, while the S&P Global Services PMI survey indicated the possibility of higher employment rates, future wage growth and inflation. In general, inflationary pressures remained historically high in May. The rate of increase in cost burdens accelerated again, hitting a new high streak. Speakers stated that higher input prices were caused by increases in fuel, energy, and supplier costs, along with increased wage bills,” S&P reported.

The S&P Global Purchasing Managers’ Index changed little in May, although contradicting some of the details with the equivalent Institute for Supply Management survey that emerged shortly thereafter, which fell 1.2 points to 55.9. The slowdown in the sector is due to declining business activity and slowing supplier deliveries. The employment index (50.2 percent) returned to growth territory, and the backlog of orders index grew, albeit at a slower rate. COVID-19 continues to disrupt the service sector, as does the war in Ukraine. The Industry Authority said employment is still a big problem and prices continue to rise.

More importantly, both surveys suggested that the demand for workers continues to rise along with their demands for wages and some other prices, things that could increase inflation and encourage the Fed to continue raising US interest rates in significant increases throughout the rest of the year.

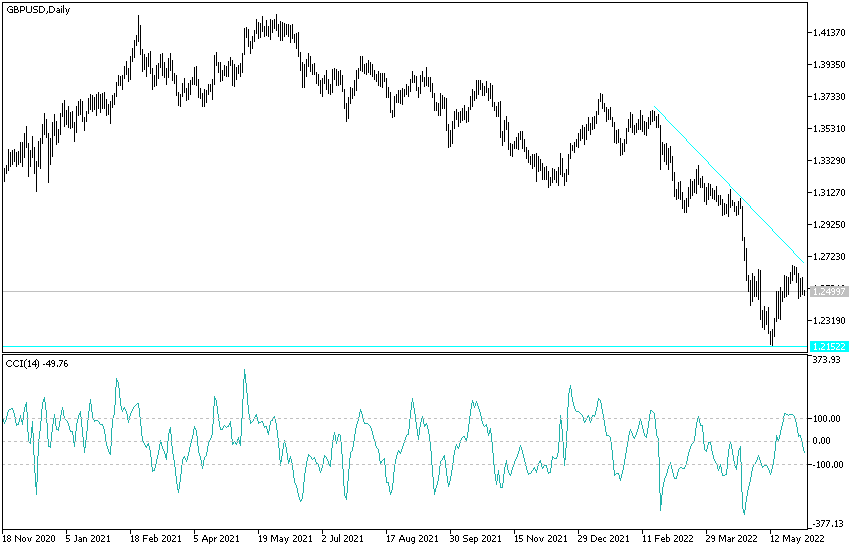

According to the technical analysis of the pair: The clear discrepancy between the Federal Reserve and the Bank of England in the course of raising interest rates will remain an important factor in threatening any gains for the GBP/USD pair in the coming days. Sterling dollar gains will remain subject to selling especially as the Bank of England remains pessimistic on the reaction from continuing to raise rates. So far, the currency pair has been unable to gain momentum to continue in the bullish channel that was formed recently, amid halting the dollar’s gains against everyone temporarily.

The bulls will need to move towards the resistance levels 1.2680, 1.2860 and 1.3000 to confirm that the general trend will turn to the upside. In the same time period on the daily frame, stability below the 1.2465 support will be a threat to the bullish expectations.