During the middle of this week’s trading, the British pound tried to recover its recent losses against the dollar, the euro, and all other major currencies. There was no clear motive for the advance but improving global investor sentiment during the US stock trading session may have helped the British Pound leaning towards gains under these conditions. However, a look at the pound’s performance shows a clear outperformance which suggests some real individual demand for the British currency. In the case of the GBP/USD currency pair, it rebounded to the 1.2599 level, and the pair kept looking for catalysts to complete the rebound, but the situation may remain cautious until the US inflation numbers are announced tomorrow. This will paint a picture of the currency pair’s trading closing for this week.

In fact, it was not only the G10’s periphery that Sterling outperformed, as gains were also recorded against some of the major names in Asia, emerging markets, and Eastern Europe. Thus, the broad nature of the advance cannot be explained by broader risk trends as there are some currencies which will almost certainly advance against Sterling if global sentiment is in the driving seat.

The gains come amid scarcity of first-order event risks for the pound, although it saw some volatility during Monday and Tuesday as global stock markets fluctuated and political intrigue was on display in the form of a vote of no confidence in British Prime Minister Boris Johnson.

However, sterling could come under pressure against the euro on Thursday if the European Central Bank indicates that a 25 basis point rate hike in July will occur in July while also confirming market expectations of a potential 75 basis point hike over the remainder of the year.

Investors are now largely anticipating such moves, and therefore they should not introduce much volatility to the Euro. However, forex currency analysts are watching for any indication that the ECB may “advance” and raise by 50 basis points at one of the upcoming meetings, believing that a more traditional 25 basis point hike is not enough given the scale of eurozone inflation.

This could set the Euro on fire and push the GBP/EUR exchange rate lower over the weekend. The Bank of England will then focus on June 16, when it will likely raise rates by another 25 basis points.

The UK rate hike comes amid rising UK inflation and a slowing economy, which are contradictory forces that don’t necessarily provide a supportive mix for the pound. Accordingly, Elias Haddad, senior currency strategist at the Commonwealth Bank of Australia, says: “The biggest issue for UK financial markets right now is the country’s move into stagflation. This will keep UK real yields very negative and mean that sterling will be trading at a significant discount to the underlying balance for some time.”

However, new research from investment bank Investec has found that “the UK’s overall outlook may be overblown” and they expect the pound to rebound over the coming months as a result. The global lender and financial services provider says that although they cut their forecasts for UK economic growth for 2022 and 2023, they do not believe a UK recession is inevitable.

Instead, the robust wage dynamics and savings spending collected during the Covid pandemic will provide a cushion to the economy during the “cost of living crisis.” “Some pessimism in the UK’s overall outlook may be overstated,” says Philip Shaw, chief economist at Investec in London. “Momentum in wages and employment is strong, and so is the store of high savings.” And Shaw adds: “We are still looking for the pound to rise, especially against the US dollar.” And “from a currency perspective, we see the most likely scenario is that the pound will rebound after its weakness since the beginning of the year.”

Accordingly, Investec expects the GBP/USD exchange rate to trade at 1.30 at the end of 2022 and 1.37 at the end of 2023. Investec expects the EUR/GBP to trade at 0.85 at the end of 2022 and 0.84 at the end of year 2023.

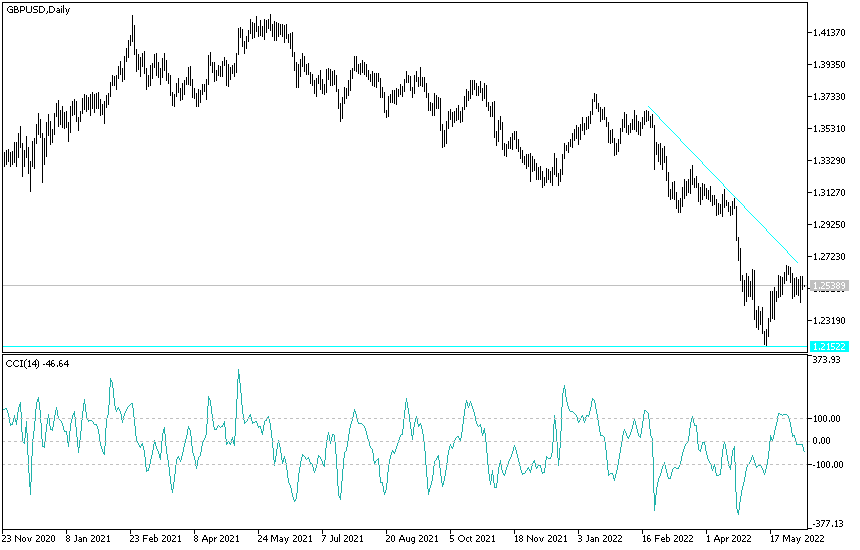

According to the technical analysis of the pair: By observing the recent performance of the GBP/USD currency pair, we find that the attempts to rebound upwards lack the momentum to get out of the vicinity of the current general bearish trend. It is the closest to returning to the 1.2480 support level, which motivates the bears to move further downwards. As I mentioned before, the sterling dollar will not have the strongest opportunity for a trend reversal without breaching the 1.3000 psychological resistance.

Today’s economic calendar is devoid of important British economic data, only the US jobless claims will be announced.