Unless the Bank of Japan changes its overall attitude, it’s difficult to imagine that this market will break down with any real significance.

The Canadian dollar rose again on Tuesday as the Japanese yen is simply floundering around the currency markets. With the Bank of Japan doing everything it can to fight interest rates rising, they are essentially buying every bond that they can get their hands on. In fact, the BOJ owns over 50% of all Japanese debt, suggesting that the Japanese yen could enter into some type of negative feedback loop.

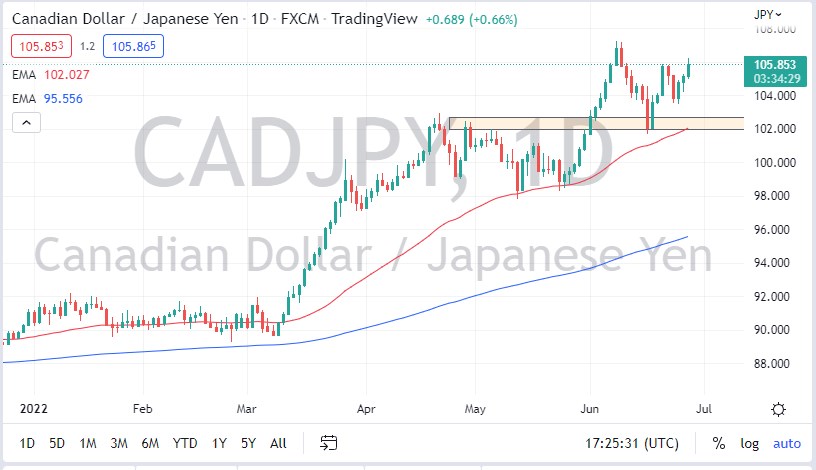

The size of the candlestick is reasonably strong, as we have broken above the ¥106 level, and it now looks as if we could go looking to reach the ¥107 level. At this point, a short-term pullback should continue to offer attractive opportunities for those looking to get involved to the upside, so I think at this point, the ¥104 level is your short-term support level, followed by the ¥102 level, where the 50-day EMA is currently sitting and rising, plus an area where we had previously seen both support and resistance.

The ¥102 level is an area that will be crucial for the longer-term health of this market, but even if we were to break down below there, it’s likely that the ¥100 level is even more supportive. If we were to break through that area, it’s likely that we will continue to break down quite significantly. Ultimately, this is a market that has more of a “buy on the dip” mentality than anything else, especially if the crude oil market continues to strengthen. However, if crude oil falls, you may see the CAD/JPY pair fall with it, or perhaps underperform. After all, the Bank of Japan aspect cannot be forgotten. In other words, this pair may rise slower than the USD/JPY pair.

More likely than not, we will probably break out and go much higher, clearing the ¥107 level and reaching to the ¥110 level. The ¥110 level has a certain amount of psychology attached to it, due to the fact that it is a round figure. Nonetheless, when you look at the very long-term charge, it’s really a situation where the ¥110 level is simply but a speed bump along the way to much higher pricing. Unless the Bank of Japan changes its overall attitude, it’s difficult to imagine that this market will break down with any real significance.