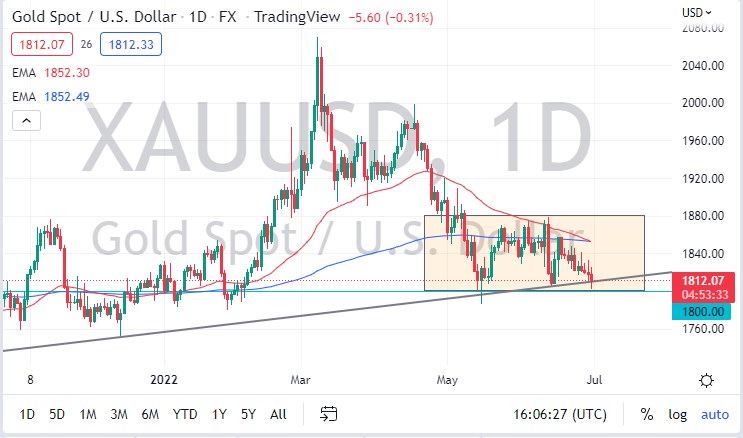

Gold markets have been all over the place during trading on Thursday, initially breaking through a major uptrend line, only to turn around and show signs of life again. At the same time, the 50 Day EMA is now crossing below the 200 Day EMA, forming what is known as a “death cross.” This is a very bearish technical signal, but is typically very late. The next move is going to be crucial for this market because we continue to probe the $1800 support level.

If we were to break down below the $1800 level, that could signify rather significant selling pressure entering the market, and perhaps a complete turnaround in the attitude of gold overall. I do believe the gold will eventually turn things around, but that does not necessarily mean that it is going to be easy. After all, the bond market continues to sell off, making interest rates in America rise. It’s much more attractive to hold sheets of paper than it is to pay for the storage of gold, which is what the money would have to do.

On the upside, the $1825 level looks to be resistance, so if we were to break above there, then it’s likely that we could go to the $1850 level, an area that I think is much more important. After that, it opens up the possibility of going to $1880, which is the top of the overall consolidation area.

If we were to break through all that, then the trend in gold would be bullish, and probably send the market looking to the $2000 level as a potential destination. We would need to see a major change in the bond markets for that to happen, so I think this short-term rally is just that, short-term. Nonetheless, I do think that if you are a range-bound trader you will continue to find the gold market to your liking, as it offers so much opportunity in both directions. Depending on your timeframe, you may be trading back and forth all day. The bond market will be key though, because it would also drive where the US dollar and interest rates go, thereby deciding whether or not gold is an attractive asset. You should also keep in mind that if you have the ability to trade spot gold, it is doing much better against other currencies.