Federal Reserve officials became more determined last month to keep raising US interest rates for longer to prevent rising inflation from becoming entrenched, even if it slows the US economy. Policymakers raised interest rates by 75 basis points last month and supported raising them at their next meeting in July by 50 or 75 basis points, according to the minutes of the FOMC’s June 14-15 meeting released Wednesday in Washington. They considered maintaining the central bank’s credibility to control inflation very important.

The yen is a popular asset during turbulent times.

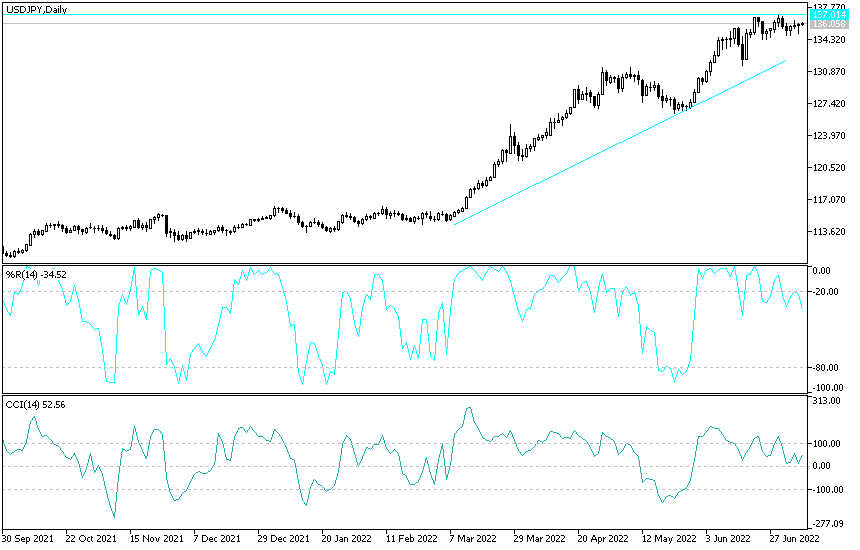

This trend contributed to the USD/JPY sticking to its gains near its highest in 24 years. This week, I tested the resistance level 136.36 and settled around the level of 135.85 at the time of writing the analysis.

The minutes of the Fed meeting also showed that “many participants saw that the big risk facing the committee now is that high inflation could take hold if the public begins to question the committee’s decision.” and “they recognized the possibility that a more restrictive stance would be appropriate if high inflation pressures persisted.” The track record has been full of references to price pressures and why it may take some time to ease them. Officials recognized that policy constancy could slow the pace of economic growth for some time, but saw inflation back to 2 percent as critical to maximizing employment on a sustainable basis. Accordingly, the two-year US Treasury yields, which are sensitive to the Fed’s policy, rose after the release of the minutes and investors continued to bet that the US central bank would raise 75 basis points later this month.

The strong push by the Federal Reserve to curb the hottest US inflation in 40 years has turbulent financial markets as investors fear that tighter monetary policy will push the US economy into recession. The word “recession” did not appear once in the minutes, compared to 90 references to inflation.

Fed officials raised their benchmark rate to the target range from 1.5 percent to 1.75 percent in June and Bank Governor Jerome Powell suggested they could do the same again in July. He told reporters at a post-meeting news conference that another 75 basis point increase, or a 50 basis point move, was likely on the table when policymakers meet July 26-27.

Officials were last month – although previously indicated they favored a 50 basis point rise – after inflation data came in hot and a leading indicator hinted that expectations for future price pressures could accelerate among US consumers.

USD/JPY Forecast

Despite the stability in narrow ranges for the USD/JPY pair, the currency pair is still in the upside range and did not experience strong profit-taking operations, as the rest of the other major currencies were exposed to against the Japanese yen, where the foundations of the strength of the US dollar are still strong and in the first place The first is the expectations of raising US interest rates strongly throughout 2022, which is supported by the distinguished economic performance of the United States of America compared to the rest of the global economies. The bulls have the opportunity to break through the resistance 137.00, the highest for the currency pair in 24 years, and to complete the general trend and break through stronger ascending levels.

On the other hand, according to the performance on the daily chart, the breach of the support levels 131.65 and 130.00 is important for the bears to control the trend.