The downward pressures continued on the gold market after it rose in the wake of the sharp inflation report from the United States of America, as investors once again turned to the dollar as a safe haven asset. Bullion on Wednesday bucked a downward trend that had seen it decline for four consecutive weeks after data showed that US inflation rose last month to a four-decade high, up 9.1% from a year earlier. The price of XAU/USD gold moved to the level of $1745 an ounce before settling around the level of $1725 an ounce as investors are betting that the Federal Reserve is likely to raise US interest rates by 100 basis points when it meets on July 26-27, a move that would enhance the chances of entering a recession in the largest economy in the world.

By Thursday, investors had digested the inflation news and once again moved away from gold to the dollar as a hedge, according to David Lennox, resource analyst at Fat Prophets. “We really need to see a much lower US dollar for gold to get a sustained positive boost going forward,” he stated. “Investors are turning to the US currency more than bullion as a haven asset.” And this year, gold prices have been volatile as Russia’s invasion of Ukraine spurred a safe-haven rally to over $2,000 an ounce in March, only for the momentum to fade as growth and inflation expectations shift. In recent weeks, investors have cut their holdings in bullion-backed exchange-traded funds.

Inflation in the US accelerated in June more than expected, underlining the relentless price pressures that will keep the Federal Reserve on track to raise US interest rates again later this month. Labor Department data showed that the US consumer price index rose 9.1 percent from a year earlier in a broad-based advance, the largest gain since the end of 1981. The widely followed measure of inflation rose 1.3 percent from the previous month, the most since 2005, reflecting the rising costs of gasoline, shelter and food.

Economists had expected a 1.1 percent rise from May and an 8.8 percent year-on-year increase, based on Bloomberg survey averages. This was the fourth consecutive month that the annual number exceeded estimates. Hot inflation figures confirm that price pressures are spreading throughout the economy and continue to erode purchasing power and confidence. That will keep Fed officials on a tough policy track to curb demand, and add pressure on US President Joe Biden and Democrats in Congress whose support has waned ahead of the midterm elections.

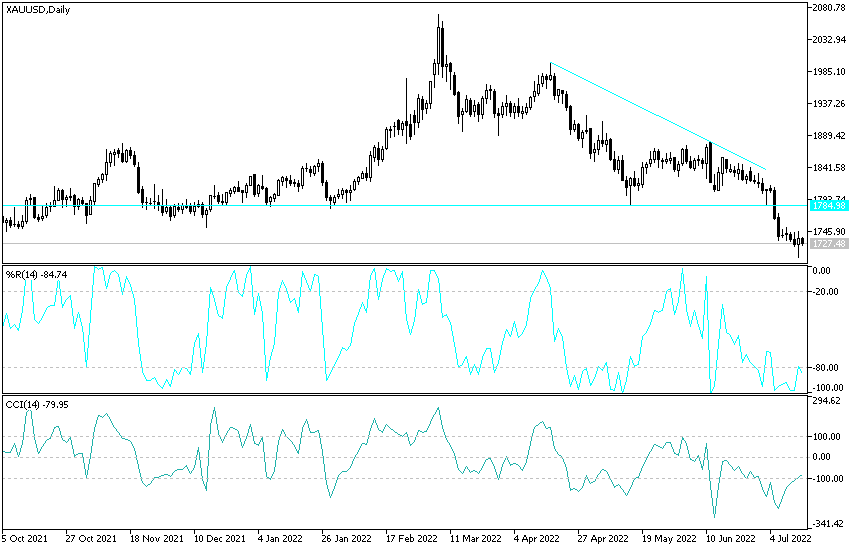

Gold Forecast

So far, the general trend for the XAU/USD gold price is still bearish, and the bulls are waiting for the prices to return towards the psychological resistance of 1800 to return to the upside and change the current outlook. I still see that gold is buying from every bearish level, as despite the trend of global central banks, led by the US Federal Reserve, towards further tightening of their monetary policy, gold is gaining momentum from the continuation of global geopolitical tensions and the return of fears of the outbreak of the epidemic again, which may disturb the future of growth of the global economy and therefore a good environment for gold.

The closest support levels for gold are currently 1716, 1700 and 1685, respectively, which are sufficient levels to push the technical indicators towards oversold levels. The price of gold today will be affected by the price of the US dollar and the extent to which investors take risks or not.

Ready to trade today’s Gold forecast? Here are the best Gold brokers to choose from.