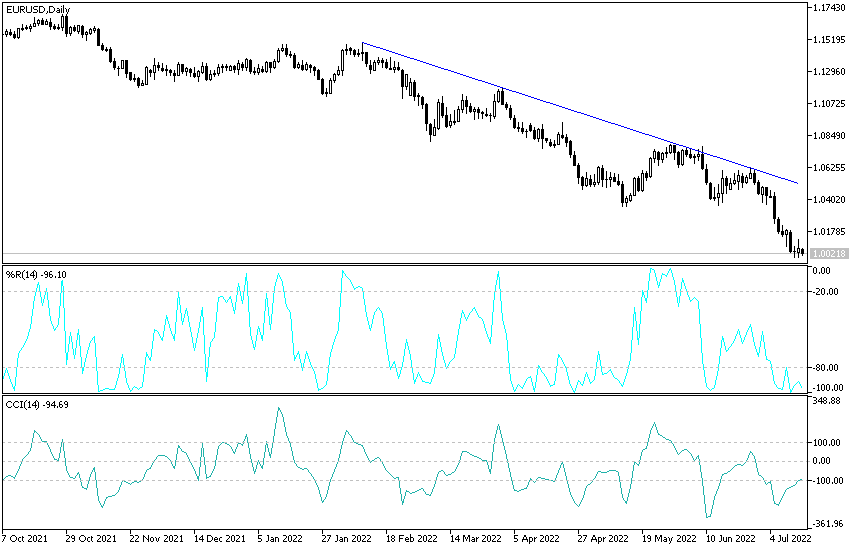

One euro is now equal to one US dollar for the first time in two decades after the historic slide in the rate of the common European currency. EUR/USD tumbled towards the 0.9997 support level for the first time since 2002. It has weakened by about 12% so far this year. With the test, the price of the EUR/USD rebounded quickly, as it is likely that there are strong buying contracts in that area, to the level of 1.0122. It settled around the level of 1.0025, waiting for anything new. Overall, a series of increasingly large US interest rate increases by the Federal Reserve has increased the value of the dollar, while the Russian invasion of Ukraine has exacerbated growth prospects in the eurozone and raised the cost of its energy imports.

This leaves the European Central Bank in a bind. It has so far resisted the kind of tight policy tightening central banks around the world are implementing, suggesting they will raise borrowing costs by a quarter point later this month. This is likely to keep the interest rate differential wide, which will keep pressure on the single currency. The euro may have narrowly avoided parity with the dollar so far, but analysts see it as an inevitable intermediate point in the slippage that could leave the common currency trading well below this milestone. The Euro quickly rebounded as the latest US inflation data fueled the Fed’s relatively hawkish outlook.

The supply of safe-haven assets such as the dollar is unlikely to recede amid a gloomy outlook for global growth. The picture in Europe is particularly bleak, given fears that stopping gas flows from Russia could trigger an economic crisis in the region and limit the European Central Bank’s ability to raise interest rates, a headwind for the currency. In this regard, analysts at ING Bank NV wrote, “We continue to believe that the chances of a break below parity are higher than a physical recovery.”

What is expected for the euro in the coming days?

Nomura Holdings Inc, UBS Group AG, and BCA Research Inc. The price of the euro drops to $0.90 by winter in a worst-case scenario. It’s already down about 12% against the dollar this year. Technically, the bearish signs suggest that a move below parity remains the base case. At the moment, the parity coincides with the support from the trend channel in effect since February.

The Euro is even struggling to break against the British Pound. And that’s as the UK grapples with political uncertainty, the fallout from Brexit and hyperinflation – a outlook so dire that it has prompted Bank of America analysts to warn of an existential crisis for the pound. The euro posted its worst weekly performance against the pound since March last week, and has since fallen to around 84.20 pence. It got a small boost on Wednesday after Bank of England Governor Andrew Bailey hinted at a larger rate hike, rising 0.4% to $1.1936.

Dominic Banning, FX analyst at HSBC, expects the pair to trade back towards 84/83 pence, with a lot of negative news now pricing in the Pound. He said that while he is not recommending a direct buy of the pound – especially against the dollar – it may start to make progress against the euro. Not everyone agrees. Whereas Matthew Savary, analyst at BCA Research Inc. He sees the Euro going back to 90p due to strong headwinds facing the British Pound. However, he urged caution about trying to name the bottom of the euro against the dollar, especially as it dips below $1. “There are high chances that the automatic selling will be triggered if the euro tests parity, which will lead to a successive decrease in the euro’s entry into a zone that has not been drawn for the past 20 years,” he said. “Don’t be a hero.”

EUR/USD Forecast

The EUR/USD price is still very close to the parity price of 1.0000 and will be subject to more selling if the euro does not gain any momentum or the strength of the US dollar stops, even temporarily until now. It is still supporting the course of the US Federal Reserve’s tightening policy. Expectations have now increased that the bank will raise a full point in this month’s meeting, which will be negative for the EUR/USD pair. Currently, the closest support levels for the euro are 0.9955 and 0.9880, respectively.

All technical indicators have reached oversold levels, and international banks have often hinted at the existence of strong purchase contracts for the euro-dollar from the parity level, which explains the current cautious stability. The EUR/USD’s upcoming gains will remain vulnerable to a rapid collapse.

Ready to trade our Forex daily forecast? We’ve shortlisted the best Forex trading brokers in the industry for you.