I think you have to look for opportunities to take advantage of “cheap US dollars” by fading signs of exhaustion.

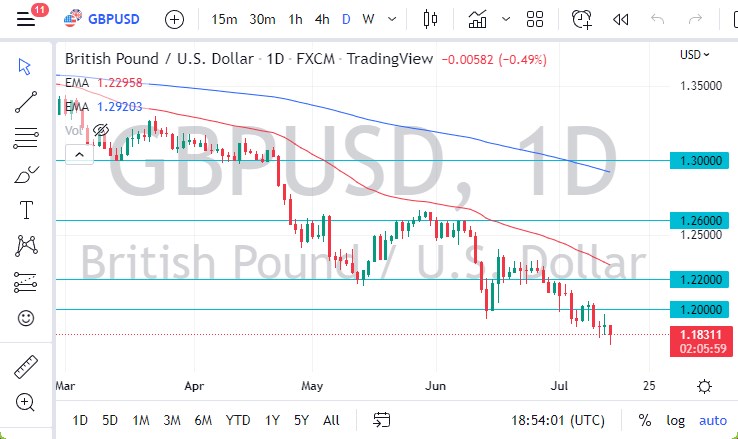

The British pound has plunged lower during the trading session on Thursday only to turn around and rally again. It looks as if we are going to see a bit of a fight near the 1.18 level, which makes sense considering that it is a large, round, psychologically significant figure. Furthermore, you could make an argument for a market that is oversold, so a little bit of a recovery bounce would make a certain amount of sense.

If we do break down below the bottom of the candlestick for the Thursday session, then I think it opens up the floodgates, and we go much lower. With that, I think we have a situation where you could see the British pound drop down to the 1.16 level given enough time. Either way, I do not have any interest in trying to buy this market, because the US dollar is by far the strongest currency in the world and with good reason. After all, the Federal Reserve is going to continue to tighten monetary policy, and therefore the greenback will continue to attract a lot of inflows.

Beyond that, there are a lot of concerns when it comes to the potential of a global recession, and therefore people will be looking to run to the US dollar for safety. The trend is decidedly to the downside as well, so I think it’s probably only a matter of time before we get down there the 1.20 level continues to offer resistance, just as the 1.22 level will. Because of this, I think you have to look for opportunities to take advantage of “cheap US dollars” by fading signs of exhaustion. I do believe that eventually rallies will run out of steam, and that’s probably something worth paying close attention to.

I do not have a scenario in which I would be a buyer, unless the Federal Reserve changes its overall tune, and starts to talk about being less tight than originally thought. I don’t think that’s going to happen in this environment, because quite frankly inflation has gotten so far out of control that I think they have no choice but to tighten monetary policy in order to drive it back down. There is a bit of a narrative on Wall Street that we have hit “peak inflation”, but that’s probably a dream. Ready to trade our daily Forex forecast? Here’s a list of some of the best Forex trading platforms to check out.