We expected the price of the USD/JPY currency pair to move towards the 140.00 psychological resistance as soon as the bulls breached the 137.75 resistance level. Around the resistance 138.50 so far, the opportunity for psychological resistance 140.00 is still strong, as the US dollar is still the strongest, supported by the expectations of raising US interest rates strongly during 2022 to contain the US record inflation, which reached the highest in 40 years.

The yen is a popular asset during turbulent times.

As was announced recently, inflation in the US rose to a new high of 9.1% in June, and while core inflation – which ignores energy and food prices – fell from 6% to 5.9%, the monthly figure strongly surprised the upside and suggested a way back to the 2% target would be long and hard. Overall, the big picture should continue in favor of the dollar for the time being.

The FOMC will have to remain hawkish at the July meeting and beyond, further bolstering the US dollar yield. Accordingly, analysts expect the DXY to move above the resistance 109. However, there was some relief for beleaguered financial markets on Friday after Chinese retail sales numbers surprised strongly on the upside of market expectations for June after sales rose at the strongest pace since February.

But with coronavirus infections on the rise again and the country continuing its attempts to stamp out the virus, many analysts continue to see the Chinese economic outlook as a source of risks to the global economy as a whole. As long as China sticks to its “Covid Zero” target, more domestic economic disruptions are likely. Recently, China announced its highest daily tally of Covid-19 cases since May 25.

Putting the Chinese economy aside, persistent increases in inflation have prompted global central banks to take action on interest rate policy on a scale not seen in decades, which in turn has raised concerns in and around markets about the risks of rate makers going too far from their economies.

These concerns were the main drivers of the strong dollar rally, but it may also be fitting that the dollar appears to be approaching technical barriers against some currencies on Friday. This was particularly the case with regard to the euro and the Swiss franc. The Swiss Franc and the Euro are both major components of the US Dollar Index and can work effectively to slow down the progress of the measure in the coming days or weeks, if not stop it completely, while any such result is also likely to be positive for the British Pound and other currencies as well. . .

But a lot also inevitably depends on the market’s reading of event risks this week including the June inflation figures from the UK and the European Central Bank’s monetary policy decision in July, and many analysts are still bearish in their forecasts for the pound and other non-dollar currencies.

USDJPY is close to breaking the historical resistance of 140, the lower bound that could make Japanese policy makers more nervous, although Japan is perhaps one of the countries in the world that can better tolerate a devaluation of its currency. GBPUSD is also expected to remain weak, having already dragged to 1.1761 and selling the pair higher remains preferable for the time being.

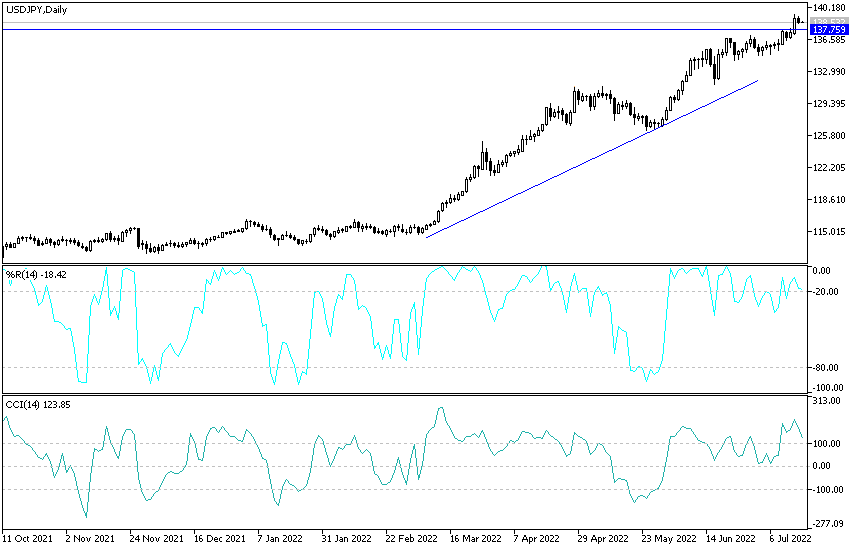

USD/JPY Technical Analysis

In the near term and according to the performance on the hourly chart, it appears that the USD/JPY is trading within a bearish consolidating triangle pattern. This indicates a slight short-term bearish momentum in the market sentiment. Therefore, the bears will look to extend the current decline towards 138,215 or lower to the 137.936 support. On the other hand, the bulls will look to pounce on profits at around 138.775 or higher at 139,054.

In the long term and according to the performance on the daily chart, it appears that the USD/JPY currency pair is trading within an ascending triangle formation. This indicates a significant long-term bullish bias in market sentiment. Therefore, the bulls are looking to extend the current rally towards the resistance 139.393 or higher to the resistance 140.403. On the other hand, the bears will target long-term profits at around 137,441 or lower at 136,432.

Ready to trade our daily Forex forecast? Here’s a list of some of the best Forex trading platforms to check out.