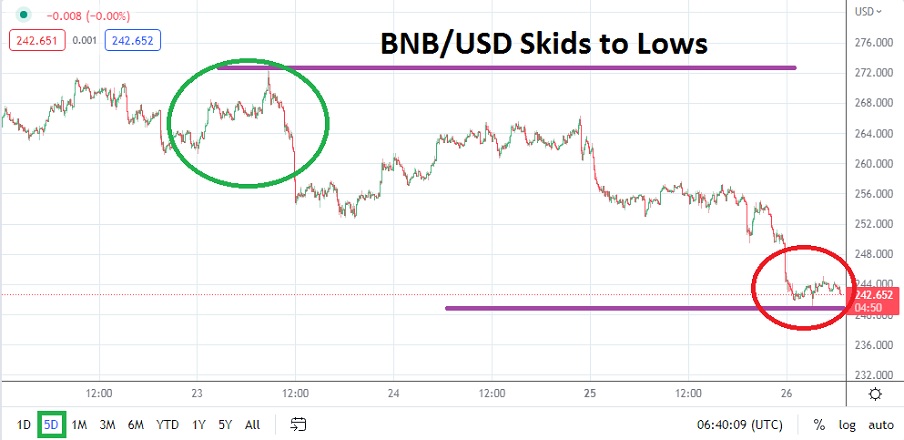

BNB/USD has skidded lower in the past day of trading, as the cryptocurrency world has suddenly begun to display nervous selling throughout the marketplace again.

BNB/USD is trading near the 242.0000 level as of this writing, trading conditions are fast and nervousness has seemingly ignited in the cryptocurrency world again. Speculators who have been pursuing bullish positions have likely experienced a rapid elevation of tension in the past two days of trading. While the cryptocurrency market began to show signs of erosion this weekend, late trading last night produced another slide lower which likely served as strong reminder strong selling influences have not vanished.

Binance Coin Producing Sharp Lows as Volatility Ramps up in Cryptocurrencies Again

On the 19th of July BNB/USD was flirting with a value of nearly 275.0000. This high had last been seen on the 11th of June, which was a day BNB/USD suffered steep declines. The current value of Binance Coin promptly puts its ratios within sight of important support levels. If the 240.0000 juncture shows signs of vulnerability BNB/USD could quickly see a test of the 239.0000 to 233.0000 range.

Since trading at nearly 217.0000 on the 13th of July trading for BNB/USD had produced steady gains until the middle of last week. Cryptocurrency traders who felt compelled to chase the upside may have profited if they participated in the buying action, but resistance began to be produced. While the moves higher in BNB/USD were solid and other major digital assets did well also, Binance Coin and its counterparts were not able to climb out of its technical long term lows and wave good-bye.

- Nervous trading in BNB/USD should be monitored; another selloff and renewed tests of the lower range would be a negative signal and could produce more selling.

- Current support near 240.0000 appears vulnerable.

Binance Coin Reversal Lower Mirrors Nervous Sentiment that is Igniting

The moves higher in BNB/USD were solid and reversals upward will likely happen again. However, the question is if the move higher was just a temporary blip in what has been a long term bearish trend. If current selling escalates and support at 240.0000 crumbles and BNB/USD has a hard time maintaining prices in the 230.0000 to 239.0000 junctures, this would be a troubling sign. Skeptics who remain sellers in cryptocurrencies may be asking if we have seen the lowest of the lows, and be wondering if new depths can be found.

Binance Coin Short-Term Outlook

Current Resistance: 246.5000

Current Support: 240.2500

High Target: 261.9000

Low Target: 227.1000