The EUR/USD pair experienced near and far setbacks during last week’s trading, but the risk of a long-term rise in US government bond yields would threaten to push it to July lows if US inflation figures further tighten the Fed. With the start of this week’s trading, the EUR/USD pair settled in tight surroundings between the level of 1.0160 and the level of 1.0222 and settled around the level of 1.0190 in the beginning of trading today, Tuesday.

During last week’s trading, the Euro-dollar approached the resistance 1.0300, but its attempts to recover were halted again due to the seemingly increasing risks to energy supplies in Germany and some other European countries. But the Russian government’s continued attempt to use gas supplies to force it out of European sanctions over its war in Ukraine aborted the euro’s early attempt to recover last week and could remain a headwind for the single European currency in the coming days.

Influencing Factors:

Jordan Rochester, Nomura Strategist says. Electricity prices in Europe are setting new record highs this week, and while it’s strange that this alone didn’t push the EUR/USD lower, it’s only a matter of time, in our view. This week, a drought in Germany may cause the water level on the Rhine to drop below 40 cm (the shallower part of the central part of the river), making the river almost impassable for cargo,” he added. “About 30% of the coal is transported Germany’s iron ore and natural gas are along the river, with drought levels in 2018 dropping 0.4-0.7% of 2018 GDP. If this happens, Rochester and colleagues warned Friday, it would add further delays in the supply chain, but also make production Coal electricity is more difficult at a time when Germany is trying to move away from Russian gas.”

It wasn’t just energy supply risks that weighed on the euro’s ankles, as the message coming from the latest US economic data was also a mounting headwind after reviving a previously stalled rally in US bond yields and the dollar last week. It comes after the Institute for Supply Management’s Purchasing Managers’ Index (ISM) surveys of the US manufacturing and services sectors rose for July in contrast to their more dismal peers in Standard & Poor’s Global, which suggested late last month that the all-important services sector contracted in July.

Meanwhile, last Friday’s US non-farm payrolls report offered an open mockery of the notion that the US economy may be close to recession and was most notable for the strong increase in average hourly wage growth, which could have implications for the Fed’s policy outlook.

Pooja Sriram, an economist at Barclays, wrote in a research briefing Friday: “Along with signs of a weak labor supply, risks to sustained wages and inflationary pressures appear to be rising.”

After the strong July employment report, a 75 basis point rise at the September FOMC meeting is still on the table, with the potential to lift that volume. However, we maintain our baseline forecast for a 50bp rise, given that the Fed will have a wide range of data to consider in the extended meeting period (~7 weeks), including the print of July CPI this week and a set other data from employment and consumer price index in September”.

In general, the dollar has fallen with the euro benefiting since mid-July after a series of bad economic data that indicated that the US economy is slowing down faster than expected by the Federal Reserve, which also indicated late last month that it is likely to slow the pace of rate hikes.

Economic data released last week raised expectations about the Federal Reserve’s interest rate in September and gave a new lease of life to US bond yields and the dollar, which could rise further in the coming days if Wednesday’s US inflation numbers provide more incitement to Fed hawks.

Forecast for EUR/USD:

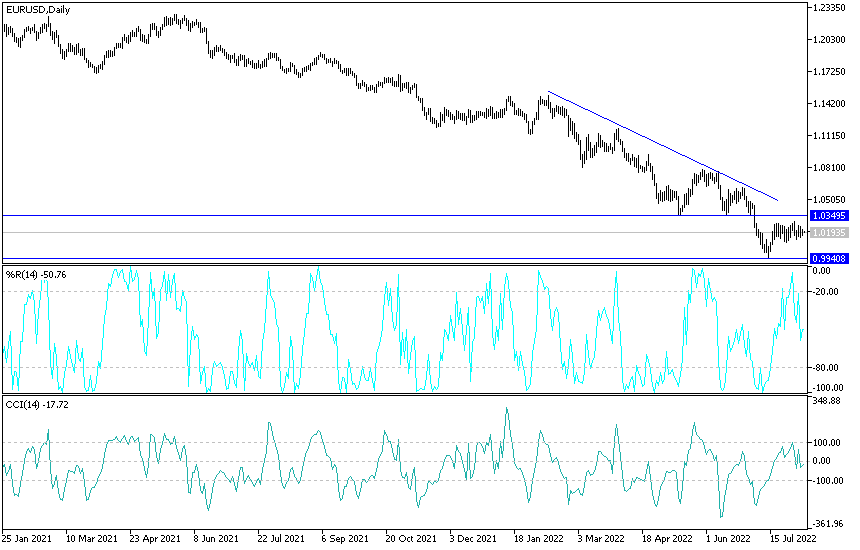

On the daily chart below, the EUR/USD is in a neutral position with a bearish bias, and a break of the 1.0130 support over the same time period will bring the bears enough momentum to move below the parity price and more. On the upside, moving towards the 1.0330 and 1.0400 resistance levels will be important for the upside trend to hold and in general I still prefer to sell EURUSD from every upside level.

Ready to trade our daily Forex analysis? We’ve made a list of the best Forex brokers worth trading with.