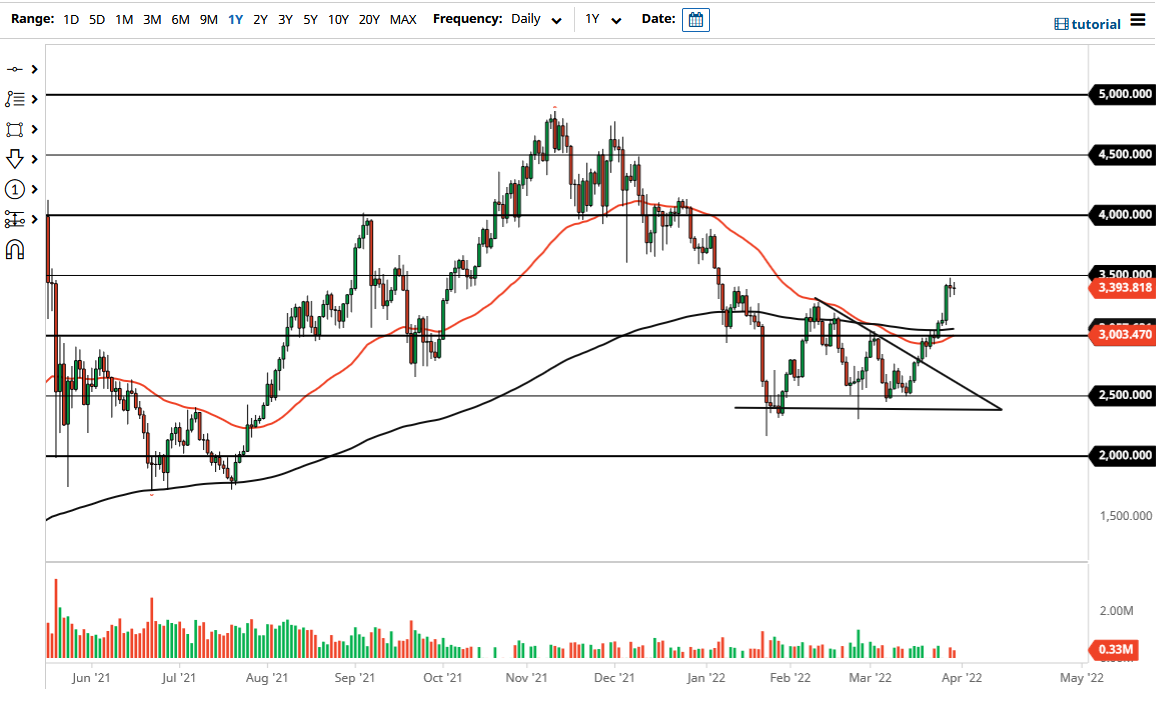

The Ethereum markets were very quiet during the trading session on Wednesday, as we hang around the $3400 level. The market is a bit overstretched at this point so we will need to see either some type of pullback or sideways movement in order to grind away some of the froth in an overbought market. Either way, it is probably a market that does very little in the short term. This is not a huge surprise though, especially when you consider how far we have rallied in such a short amount of time.

The markets will continue to be supported near the $3000 level, as the level has a certain amount of psychological importance attached to it, but also a couple of major moving averages. For example, the 50 Day EMA is currently sitting at the $3000 level, while the 200 Day EMA is sitting just above. It looks as if we are ready to form the so-called “golden cross”, which a lot of longer-term traders will pay close attention to. I do not believe in it too much, because quite frankly by the time it forms, you have missed a large portion of the move. However, the market is a bit extended, so I think it is going to take significant effort to push higher.

Ethereum has been leading the way for some time, but as you can see the market has paused. This pause can also be seen in the Bitcoin market, as well as many other smaller coins. It will all move in the same direction, and it is worth noting that we are cracking out of a “W pattern”, which is a very bullish sign, so traders will have to pay close attention to whether or not we break higher.

If we do, the “measured move” of the W pattern is a move to the $4500 level, which is basically the all-time high. I do think that eventually, we could get there, but whether or not it is easy is a completely different question altogether. Pullbacks should be thought of as buying opportunities, the impulsive move that we had seen on Monday does suggest that there should be a bit of follow-through eventually. Once we break above the $3500 level, I anticipate that a lot of people will jump into the market and try to take advantage of momentum.