I think more likely than not, we are going to get short-term rallies that can be sold on signs of exhaustion unless something changes quite drastically.

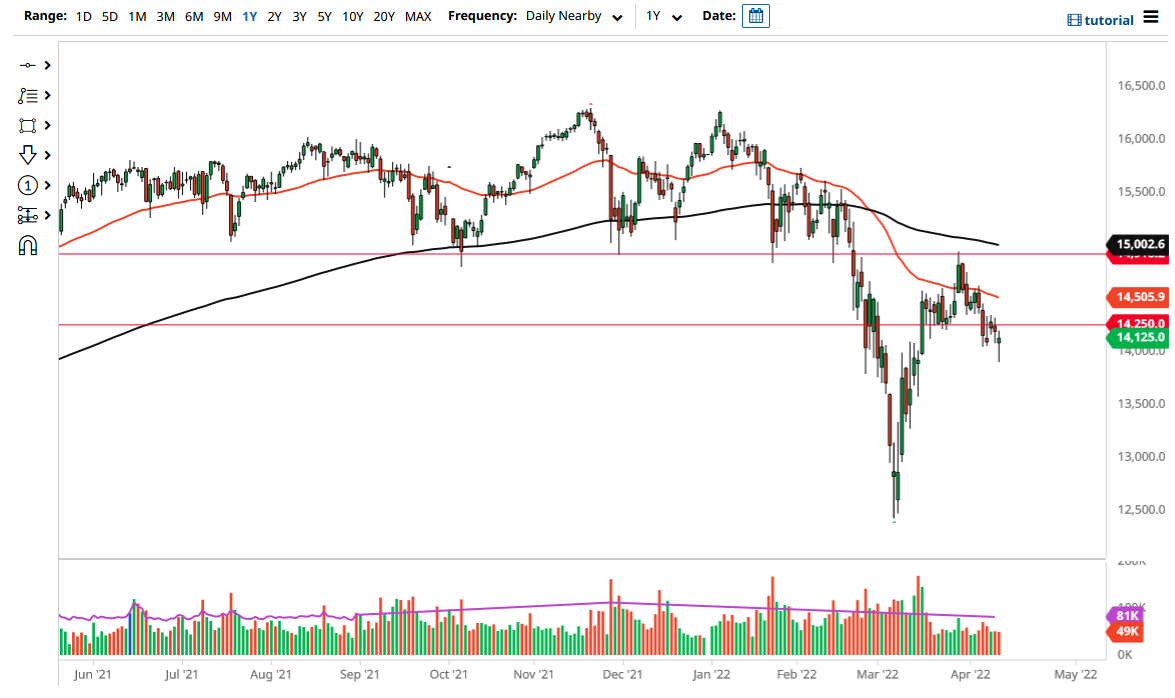

The DAX fell initially on Tuesday to break down below the €14,000 level, and at one point looked like it was ready to take off to the downside. However, we have turned right back around to form a bit of a hammer, suggesting that perhaps there are still plenty of stubborn buyers underneath. This sets up an interesting situation because if we can break above the top of the hammer, that could open up recovery in the DAX to attempt a move to recapture the €14,500 level. It is worth noting that the 50-day EMA sits right there as well.

On the other hand, if we were to break down below the bottom of the hammer for the trading session on Tuesday, that would be a very negative sign as it would show that the sellers have gotten very aggressive, not allowing the market any real opportunity to take off to the upside. When I look at the longer-term charts, I can still clearly see that we are overall in a downtrend, but this action over the last 24 hours does suggest that perhaps we are not quite ready to break down.

With that being said, if the market does rally from here, I think it is short-term relief more than anything else. If we were to take out the 50-day EMA, then we could go as high as €15,000, but that obviously would take a lot of bullish pressure. It is difficult to imagine a scenario where stocks do well in this environment because there is so much in the way of negativity out there when it comes to not only market sentiment, but inflation. The European Central Bank has no interest in trying to tighten monetary policy, so that might be the one thing that is bullish here.

That being said, I think more likely than not, we are going to get short-term rallies that can be sold on signs of exhaustion unless something changes quite drastically. If the ECB decides to start loosening monetary policy even further, that might make the DAX jump. Beyond that, I simply do not see a situation where I want to get overly aggressive for stocks in general, let alone Germany which is dealing with an energy issue.