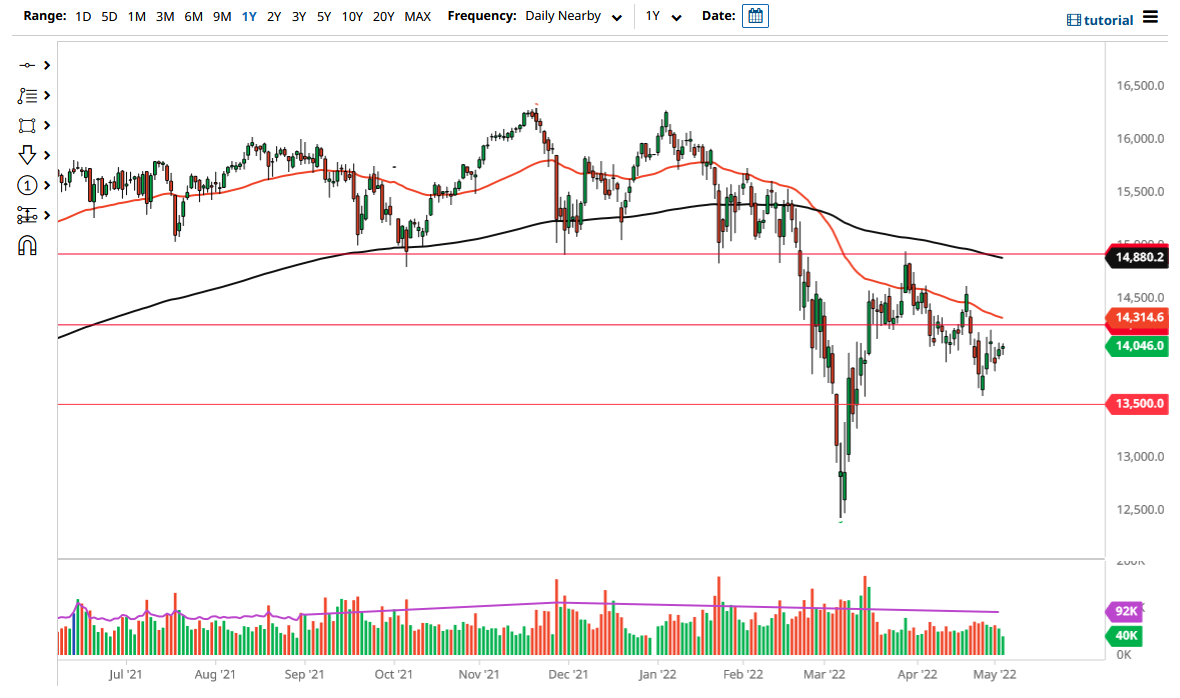

We have a couple of levels that we can pay close attention to as guides.

The German index has done very little during trading on Wednesday as we continue to build up inertia. We are hanging around the €14,000 level, an area that has been important multiple times. Because of this, I believe we are looking at a situation where we will more likely than not build up enough inertia to make a bigger move, but we need to figure out which direction that will be. The most prudent thing I can tell you to do is let the market tell you, and then follow.

We have a couple of levels that we can pay close attention to as guides. The €14,250 level is an area that I believe will more likely than not offer resistance, as we have seen it do so recently. Furthermore, the 50 Day EMA is sitting just above it and dropping. Between those two things, I think the market will struggle to get above there without some type of good fundamental news. On the downside, we have the €13,500 level, which is an area that we have bounced from previously. If we were to break down below there it would be a very negative turn of events, opening up selling down to the €12,500 level.

On the other hand, if we were to turn around a break above the €14,250 level, and of course the previously mentioned 50 Day EMA, the market would then threaten the €14,500 level, perhaps followed by the 200 Day EMA. The market would take a move like that only if good fundamental news or the ECB coming out and loosening something monetary policy-wise is the case. The Federal Reserve could have a part to play, but the rally in the DAX would be more or less a “knock-on effect” of the central bank starting to change its tune more than anything else.

Remember, as long as there is the threat of a global slowdown, the DAX will be very sensitive as so many of the big companies that make up a majority of the index are major exporters. With that in mind, I think that you need to pay attention to the global economy much more in the DAX and you do a lot of other major indices, as it is the engine of European exports in general. Pay attention to the value of the Euro as well, because a cheaper Euro also helps export.