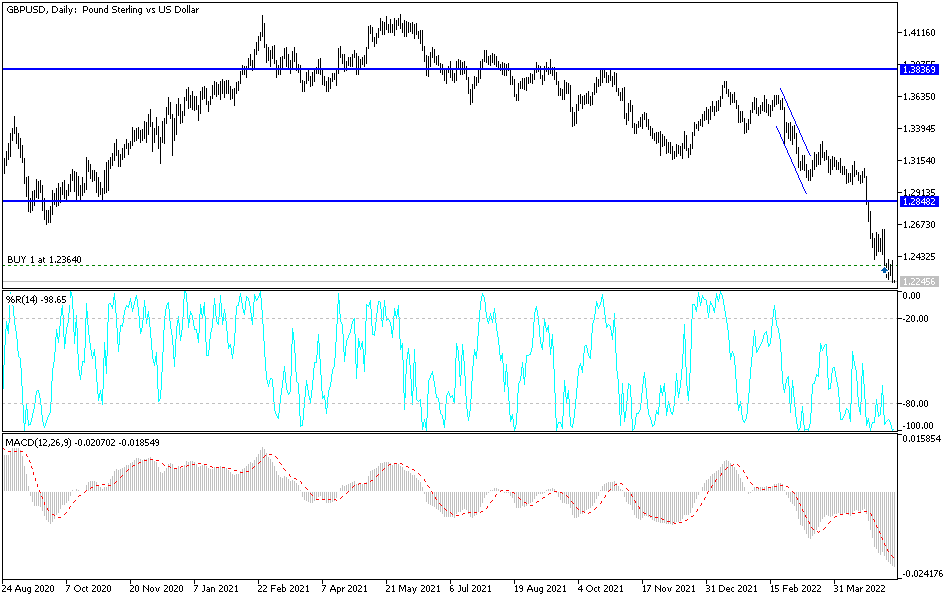

The cheery tone of global markets helped correct the heavily sold pound higher, although there is still little conviction among analysts that any bounce will sustain itself in the near term. Yesterday, the price of the GBP/USD currency pair succeeded in recovering to the resistance level of 1.2400, but with the continuation of the pessimism caused by the Bank of England, the bears regained control. The sterling dollar pair fell again in the same general path to the 1.2237 lowest support level for the pair in years, which is stable around it time to write the analysis.

Many market commentators today are picking up on the decline in US bond yields, a sign that investors may be beginning to consider the implications of peak inflation in the US at current levels. It was the sharp rise in US bond yields that raised fears of rising inflation and at the same time caused losses in global equities.

US 10-year Treasury yields have fallen to around 2.93% as inflation expectations decline, coinciding with a decline in the US dollar that tends to track the rise of Treasuries. This helped relieve pressure on global equity markets and the British Pound showing a strong positive correlation to overall sentiment. Further support for stocks comes amid signs that China’s coronavirus cases may ease, but with no sign that the authorities will ease their approach to the non-proliferation of Covid, optimism will remain cautious.

We reported at the start of the week that sterling was ready to bounce back from oversold levels, and increasingly extended positions and bull markets proved to be the catalyst needed to trigger a correction. According to the latest available position data, the British pound entered the week as the second most short-sold major currency after the Japanese yen, meaning that a sharp counter-trend return was increasingly possible.

Moreover, the British Pound exchange rate entered the new week in a particularly oversold state, with the RSI on the daily chart reading at 26.36; An RSI reading of less than 30 indicates that a financial asset is oversold. These conditions are often taken by traders to signal a rebound or stop in a downtrend, as oversold conditions cannot continue indefinitely. However, many forex analysts still see the higher corrections in the British pound sterling should be seen as temporary, especially if global markets continue to lose ground.

If the bounce in stocks extends and proves to be a real turnaround, the pound could also face a brighter outlook. The near-term recovery in various sterling exchange rates comes after the Bank of England’s May monetary policy meeting led to significant declines, leading currency analysts to expect further weakness. As such, forex analysts at ING Bank raised their expectations for the EUR/GBP exchange rate while also warning that risks to this view are to the upside.

Meanwhile, forex analysts at investment bank MUFG say they have a tactical “go long” recommendation on the EUR/GBP, anticipating further gains from the EURGBP. Investment bank Goldmans Sachs raised its target in a deal betting that the euro would appreciate more in value against the pound.

According to the technical analysis of the pair: The recent losses of the GBP/USD currency pair increased expectations of a further collapse towards the 1.2000 psychological support as an available destination for the bears dominating the direction of the currency pair. An actual and continuous reversal of the trend will not occur according to the performance on the daily chart without breaking the resistance levels 1.2855 and 1.3000, respectively. So far, the pair’s gains will remain at any time an opportunity to sell.

The GBP/USD pair will be affected today by the announcement of the growth rate of the British economy, and the announcement of the US Producer Price Index and weekly jobless claims