As I mentioned before, any gains for the EUR/USD price rebound upwards will be a target for selling, as the factors of weakness are still present. Indeed, after attempts to rebound higher with gains to the level of 1.0564, it returned to decline in its broader path down to the level of 1.0460 at the time of writing the analysis. The US dollar is still the strongest with expectations of raising US interest rates strongly during 2022, and the euro lacks this most important factor for investors in the financial markets and the currency market in particular.

In addition to the bleak outlook for the future growth of the Eurozone economy due to the Russian-Ukrainian war crisis, which particularly affects the energy sector, threatening to paralyze the European economy. So Europe is trying to cut off Russian natural gas because of the war in Ukraine, but is still finding enough fuel to keep lights on and homes warm before it gets cold again.

That has prompted officials and utilities to race to fill the underground storage with scarce supplies of natural gas from other producers — competition that is driving up already high prices as utility bills and business costs soar. Italy has announced new supplies from Algeria, while Germany has identified an energy partnership with Qatar, the main supplier of ship-delivered LNG.

And while these deals offer a long-term boost, they will likely have little impact on critical winter supplies that will be determined over the next several months. Currently, the scramble in Europe is a zero-sum game: there is little or no spare gas available to grab, and any supply any country can obtain comes at the expense of someone else in Europe or Asia.

Eurozone inflation remained unchanged in April, according to the final estimate from Eurostat, and the harmonized consumer price index rose 7.4 percent year on year, the same as in March, but lower than the initial estimate of 7.5 percent. Despite the downward revision, inflation was the highest ever.

On a monthly basis, the HICP index rose 0.6 percent, in line with estimates published on April 29. Core inflation, which excludes energy, food, alcohol and tobacco, accelerated sharply to 3.5 percent, as expected, from 3.0 percent in March. Energy continued to achieve its highest annual rate, 37.5 percent in April versus 44.3 percent in March. Food, alcohol and tobacco prices rose 6.3 percent after a 5.0 percent increase in March.

Prices of non-energy industrial goods rose 3.8 percent after a 3.4 percent increase in March. Service costs grew 3.3 percent after a 2.7 percent increase the previous month.

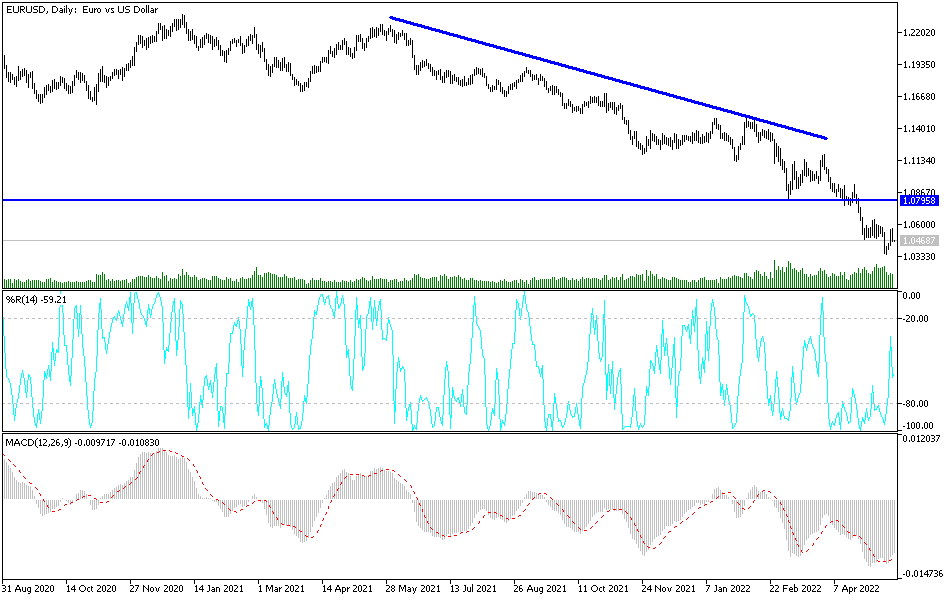

There is no change in my technical view of the performance of the EUR/USD currency pair. The general trend is still bearish, and any gains for the pair may remain subject to selling again. Weakness factors still exist, most notably the discrepancy in economic performance and the future of monetary policy tightening between the Eurozone and the United States, as well as the continuation of the Russian-Ukrainian war, which has a stronger negative impact on the Eurozone in particular. The closest targets for attempts to recover are the resistance levels 1.0520, 1.0600 and 1.0685, respectively. On the other hand, according to the performance on the daily chart, a break of the 1.0400 support will be important for the bears to move down strongly.