After Lagarde’s recent hawkish statements, the price of the EUR/USD currency pair is trying to maintain the gains of those statements, which brought it to the resistance level 1.0748 and settles around the 1.0698 level at the time of writing the analysis. Today is important for EUR/USD because of the announcement of the content of the minutes of the last meeting of the Federal Reserve US. I still prefer to sell the Euro-dollar, despite the European Central Bank’s signals, but the markets are confident that the Federal Reserve is the strongest and the fastest in the pace of raising interest rates.

Commenting on the recent performance of the Eurodollar. FX markets have miscalculated the value of the euro in relation to the risk of higher interest rates by the European Central Bank, according to a Scandinavian bank and investment bank. DNB Markets said in a new research note on currency performance that forex investors appear to be ignoring the risks posed by the European Central Bank to tighten policy, causing the euro to depreciate as a result.

They add risks to the outlook for the EUR, tilting to the upside.

Just last week the Sterling was talking about increasing expectations that were dropping in our inbox saying that the Euro was at risk of falling to parity against the Dollar. But, a few days later, the odds of this possibility seem to have diminished somewhat due to the major turnaround in the European Central Bank (ECB).

In general, the price of the euro rose at the beginning of the new trading week after the European Central Bank President Christine Lagarde reinforced expectations of a rate hike in July. “I expect net in-app purchases to end very early in the third quarter,” Lagarde said. “This will allow us to raise the interest rate at our meeting in July, in line with our forward guidance.”

“The conditions facing monetary policy have changed significantly,” Lagarde added in a blog aimed at addressing investors’ evolving expectations of future ECB policy. Three shocks combined to push inflation to record levels.”

Lagarde’s comments follow comments from other board members who have warned of a change in policy.

This was also confirmed with the release of last week’s ECB meeting minutes which indicated that a 50bp hike was now possible. However, Lagarde appears to suggest that the deposit rate will rise from -0.50% to 0% by September, hinting at two increases of 25 basis points.

“The interest rate market has already priced this in, so the reaction there to Lagarde’s comments has been moderate so far,” the analysts said. However, the EURUSD has risen significantly, confirming that the FX and interest rate markets have been a bit out of sync lately when it comes to expectations of the European Central Bank clamping down on them.” In other words: the FX market seems to have ignored that the European Central Bank is also ready to tighten monetary policy soon, which in our view is one of the reasons for the EURUSD to fall to artificially low levels.

Currently, forex investors are now waking up to the fact that the European Central Bank will join the Federal Reserve and other global central banks in tightening monetary policy.

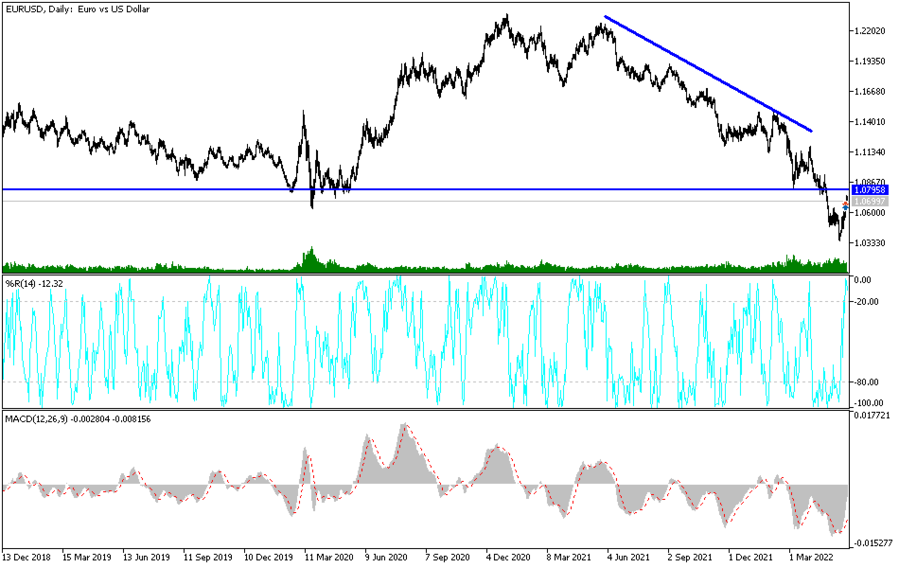

According to the technical analysis of the pair: I still expect that the recent rebound gains for the EUR/USD may be temporary and for factors that will quickly evaporate. The July date is still far away, and I see that Lagarde confirmed from his statements to ease the selling operations on the euro, especially since the Russian-Ukrainian war is still in progress. The future of energy to Europe is becoming more uncertain better selling EURUSD from the 1.0690 and 1.0775 resistance levels, respectively.

On the downside, the 1.0500 support level remains the most important for the bears to launch in the path of the stronger and clearer channel on the daily chart below. The euro-dollar currency pair will react strongly today with the announcement of the growth of the German economy, in addition to the reaction from the announcement of US durable goods orders, and most importantly, the content of the minutes of the last meeting of the Federal Reserve.