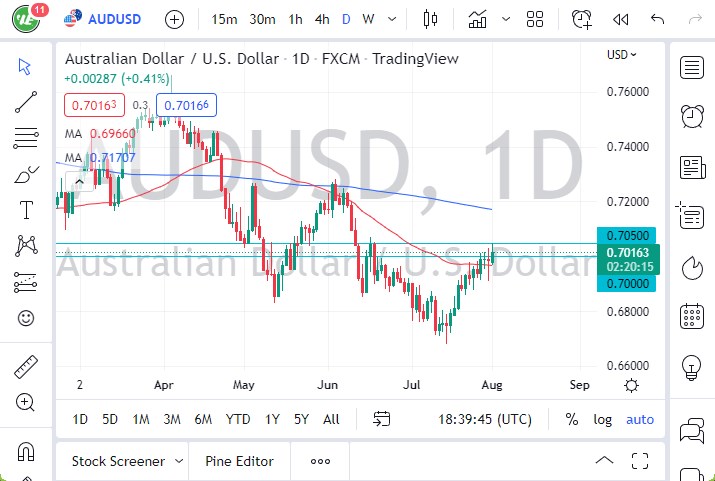

Bullish breakout from long-term bearish wedge pattern.

My previous signal on 19th July produced an excellent, nicely profitable long trade from the bullish inside pin bar which rejected that level.

Today’s AUD/USD Signals

Risk 0.75%

Trades may only be taken prior to 5pm Tokyo time Wednesday.

- Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 0.6875, 0.6895, or 0.6915.

- Put the stop loss 1 pip above the local swing high.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

Long Trade Ideas

- Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 0.6797, 0.6784, or 0.6719.

- Put the stop loss 1 pip below the local swing low.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

AUD/USD Analysis

I wrote in my previous forecast on 14th July that the AUD/USD currency pair was looking bearish so I was seeking a short trade from a return to the 0.6800 area before looking for a bearish reversal to signal a short trade entry.

The price did fall over that day, so I was at least partially correct to look to the short side, although it never got back to 0.6800 before making a significant low and a dramatic bullish bounce at the support level of 0.6683 during the second half of the day’s New York session.

We saw the US Dollar begin to sell off last Thursday, producing a major bottom here which now looks like a very significant bullish reversal. The price has broken out of the long-term bearish wedge pattern, as you can see from the broken upper trend line shown within the price chart below, which is a bullish sign.

The Australian Dollar has also received a boost a few hours ago as the Reserve Bank of Australia released the minutes of its latest policy meeting. This contained no real surprises but showed that taking all necessary measures against inflation remains a real and actionable top priority, and this is helping the Aussie rally now. Technically it has room to rise, as the price has got established above the 0.6800 area.

The advance may now be beginning to falter as the price reaches an area of a bearish inflection, but long trades remain attractive after pullbacks. I will be happy to go long if the price falls to 0.6800 and we quickly get a firm bullish bounce there.

There is nothing of high importance scheduled today concerning the AUD or the USD.

Ready to trade our free Forex signals? Here are the best Forex brokers to choose from.