The exchange rate of the euro against the dollar achieved only partial gains compared to the decline of the US dollar in recent days. EUR/USD enters the new week’s trading on a more stable basis and could perform better in the coming period if the single European currency succeeds in overcoming the risks of the looming US economic data. The EUR/USD pair recorded gains towards the 1.0275 resistance level, which is stable around it at the time of writing its highest analysis in a month.

In general, the single European currency EUR came under pressure against the rest of the currencies last week amid intense market focus on reduced European gas supplies. It pushed prices higher for a brief period and led the European Union to agree to a rationing plan that would further impede continental economies during the winter.

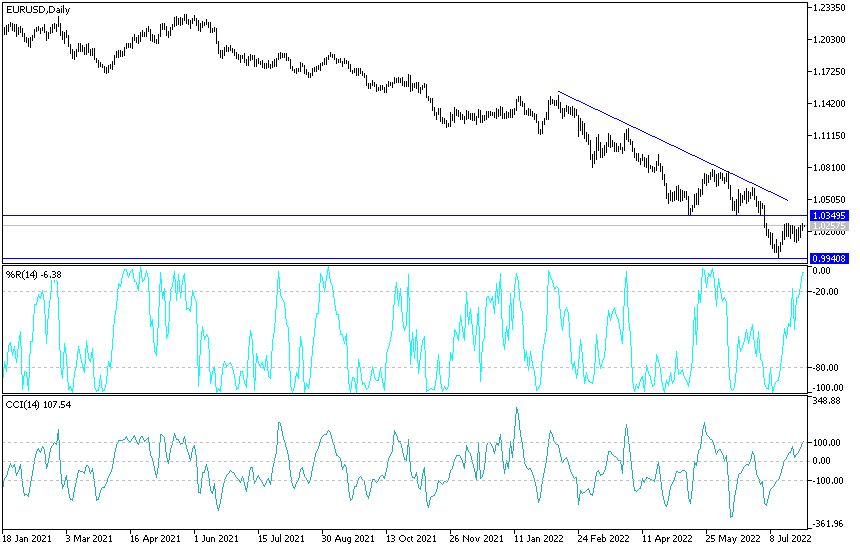

This Russian protest against sanctions related to the invasion of Ukraine hampered the EUR/USD rate last week but was not enough to push it below the emerging technical support level around 1.0116, which the single European currency tested but persisted on several occasions. The Euro’s losses were limited by the dollar’s selling in the wake of the Fed’s decision last Wednesday, and it is now entering the new week on a stronger basis with technical resistances around 1.0246 and 1.0272 in crosshairs.

Commenting on the performance, Lee Hardman, a currency analyst at MUFG, said, “After the Fed indicated that the pace of US interest rate hikes is likely to slow in the future and make future policy decisions more data-intensive, we decided that the remaining risk balance for the US dollar was in the longer term. The relative was not favorable.”

USD Reacts to Fed Decision

The dollar’s reaction to the Federal Reserve’s decision last week has led the analyst and his colleagues to suggest that institutional clients of the bank’s earnings are walking away from a previous bet against the single currency, which briefly fell below par with the dollar during mid-July. The analyst added, “Although we do not expect the massive sell-off in the US dollar to prove sustainable, we would prefer to reduce the long exposure to the US dollar until the dust settles. Economic data from the Eurozone has also been more supportive of the Euro than expected over the past week.”

The Euro also received more steady support with the release of Q2 GDP and inflation data for July released on Friday, indicating that Eurozone economies are holding up better than many feared during the first half of the year. According to official figures, the European economy grew 0.6% in the three months to the end of June after an upwardly revised 0.6% growth to open the year, while overall and core inflation measures rose more than expected for July, with potential implications for European Central Bank policies.

Analysts now expect the eurozone to be in recession in the second half of this year; Spot data is already slowing materially, and more production disruptions are likely,” warns Michael Cahill, Goldman Sachs forex analyst, noting the ongoing risks to gas supplies in Europe. Many analysts and economists are still bearish in their forecasts for the single European currency and European economies, although not everyone belongs to this school of thought, and the Euro is entering the new week’s trading on firmer grounds than it was at any time in July.

Whats coming this week?

This week will be a busy period for the US economic data that will bring with it risks and opportunities for the single European currency. The Institute of Supply Management’s (ISM) Purchasing Managers’ Index (PMI) surveys on Monday and Wednesday are major highlights of the US calendar and markets are likely to look to see if they confirm the bleak message of the S&P Global surveys, although the US jobs report is not. July agricultural will be very important.

The FOMC continued to play down signs of deteriorating demand as it raised the funds rate by another 75 basis points. For many currencies, there is a risk that this week’s numbers and upcoming speeches from Fed rate-setting committee members have positive effects on the dollar relative to markets’ assumptions about interest rates from September onwards, which were revised downward after last week’s policy decision.

This could potentially involve downside risks for the EUR and a possible retest of the emerging level of technical support around 1.0116

Technical Forecast for EUR/USD:

EUR/USD is moving within a narrow range visible on its short-term time frames, and it appears that another test of resistance is expected. Price could bounce back off 1.0250 minor psychological mark. If so, EUR/USD could find its way back to range support around 1.0115. Technical indicators are indicating that the general trend remains bearish, and the top of the range is likely to keep gains in check.

So far, despite the recent performance, the 100 SMA is still below the 200 SMA to indicate that downward pressure is in place, but the pair has already climbed above both indicators as an early bullish sign. In addition, both moving averages can hold as dynamic support on dips to 1.0200. Stochastic is turning bearish after briefly staying in an overbought area, which indicates that downward pressure is increasing. On the other hand, it is possible to leave the RSI neutral, to reflect the conditions of the limited range.

As mentioned before, EUR/USD may take its cues from high-level US data this week, including the release of NFP numbers on Friday. There is another pace of slowdown in hiring, which could lead investors to suspect that the Fed can continue its violent tightening cycle.

Ready to trade our Forex daily forecast? We’ve shortlisted the best Forex brokers in the industry for you.