The Dow Jones Industrial Average rose slightly during its recent trading at the intraday levels, to achieve slight gains in its last sessions, by 0.09%. It gained about 29.08 points, and settled at the end of trading at the level of 32,832.55, after its rise during Friday’s trading by 0.23%.

Current volatility is making great stock trading opportunities – don’t miss out!

Traders were hoping that a strong labor market would defy the latest evidence of a slowing US economy, as the quarterly corporate earnings season draws to a close, which was well-received in the second quarter overall.

But last week’s strong jobs report for the month of July makes it more difficult for investors to think that the Fed will rely on its plans to raise interest rates at its next meeting next month, as Friday’s solid work report indicates that companies have not cut employment distance.

Investors were also weighing the implications of the massive healthcare, climate and tax package passed by the Senate in a party-line vote on Sunday, giving President Joe Biden a political victory. The package is expected to win approval in the Democratic-controlled House of Representatives.

Traders are now waiting for the CPI to be released on Wednesday, with economists expecting an 8.7% YoY increase which will be down from 9.1% in June. The market now needs to see that inflation is going down, or else it will assume that the Fed will remain somewhat aggressive in raising interest rates and stocks will collapse.

Technical Analysis

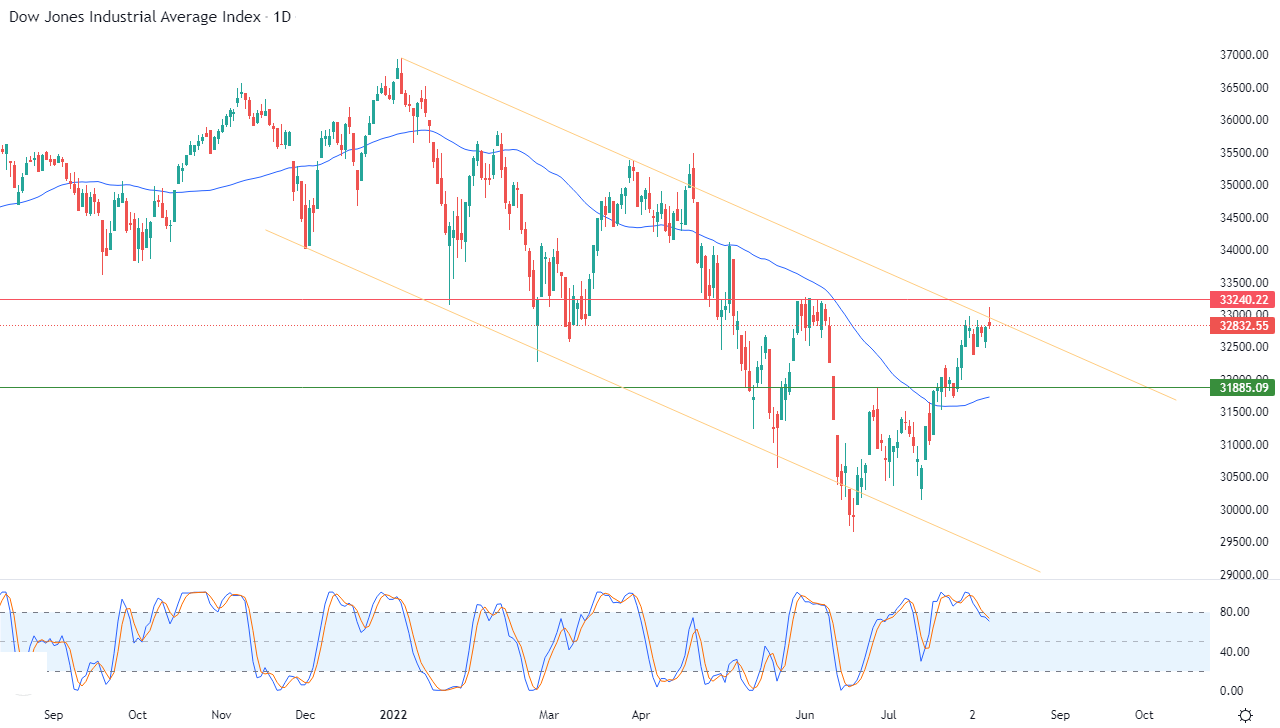

Technically, the index is rising with the support of its continuous trading above its simple moving average for the previous 50 days, until it reached its last trading to test the ceiling of that bearish corrective price channel that limits its previous trading in the short term, as shown in the attached chart for a (daily) period, with the influx of Negative signs on the RSI indicators, after reaching overbought areas.

Therefore, our expectations suggest a return to the index’s decline during its upcoming trading, as long as the resistance level 33,240 remains intact, to target the support level 31,885.

Ready to trade the Dow Jones in Forex? Here’s a list of some of the best CFD trading brokers to check out.