Today’s recommendation on the lira against the dollar

Risk 0.50%.

Yesterday’s sell trade was activated, and the exit was made after making a profit with closing half of the contracts and moving the stop-loss point as the price progressed towards the target.

Best selling entry points

- Entering a short position with a pending order from levels of 18.33

- Set a stop-loss point to close the lowest support levels at 18.55.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 55 pips and leave the rest of the contracts until the strong resistance levels at 17.70.

Best entry points buy

- Entering a buy position with a pending order from levels of 17.85

- The best points for setting stop-loss are closing the highest levels of 17.54.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 55 pips and leave the rest of the contracts until the support levels 18.31

Analysis of the Turkish lira

The price of the Turkish lira stabilized against the US dollar during the early trading of today, Wednesday. The interventions of the Turkish Central Bank clearly appear in the price movements of the lira strongly against the dollar during a specific time within today’s trading before the pair returns to the normal course of trading. The Turkish Central Bank pumped dollars in liquidity into the markets to preserve the value of the lira, especially after the increase in the volume of foreign reserves in the country thanks to Russian transfers that took place in order to start implementing a nuclear plant in Turkey. The lira, which has halved against the dollar over 12 months, is suffering. This was reflected in inflation in the country, which recorded its highest level in 24 years at 79.6 percent during the month of July. The price of the lira is not expected to improve in light of the continuation of the current monetary policy without changes.

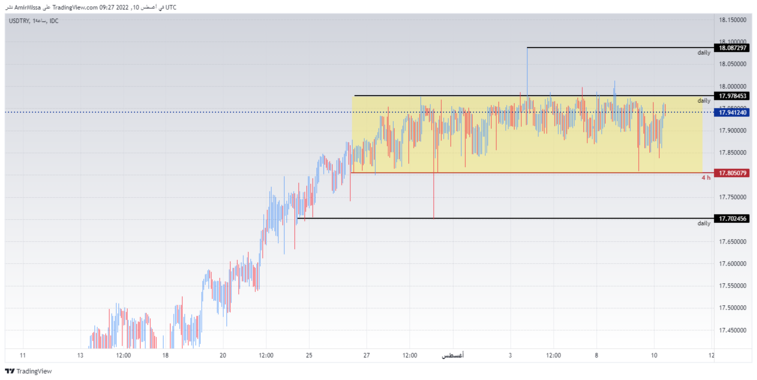

On the technical front, the USD/TRY currency pair settled near its highest levels this year. With the exception of a strong movement that appeared quickly during yesterday’s trading, the lira strongly pushed against the dollar before the pair returned to where the narrow trading range is, with the same trading image that the pair has been following since the beginning of this month, which is shown in the chart. The pair is trading above the 50 and 100 moving averages and 200, respectively, on the four-hour time frame as well as on the 60-minute time frame, indicating the bullish trend over the long term. At the same time, the pair is trading the highest levels of support, which are concentrated at 17.90 and 17.85 levels, respectively. While the lira is trading below the resistance levels at 18.00 and 18.07, respectively. We expect to re-record new highs, especially with every dip in the pair, which represents a buying opportunity. Please adhere to the numbers in the recommendation with the need to maintain capital management.

Ready to trade our Forex daily analysis and predictions? Here are the best Forex brokers to choose from.