Gold futures cut a series of losses that lasted three sessions and rose to the highest level. It reached the resistance level of 1938 dollars an ounce, before the price of gold settled around the level of 1923 dollars an ounce. According to reports, Russia attacked certain areas of Ukraine that were part of the Moscow undertaking. Doubts about Russia’s pledge made the mood in stock markets a bit bearish and prompted investors to look for safer assets like gold. In addition, the weakness of the US dollar contributed significantly to the sharp rise in the price of gold.

Moscow has vowed to halt military operations around Kyiv and Chernihiv in an attempt to stop the escalation of the war. Ukraine responded with skepticism to the promise, while the United States warned that the threat was far from over. US President Joe Biden asked if the Russian announcement was a sign of progress in the talks or an attempt by Moscow to buy time to continue its offensive.

Moscow’s chief negotiator, Vladimir Medinsky, said there was still “a long way to go” to reach a joint agreement with Ukraine.

A report issued by the ADP Payroll Processor showed that private sector employment in the US jumped by 455,000 jobs in March after rising by 486,000 jobs, revised upwards in February. Economists had expected US private sector employment to rise by 450,000 jobs, compared to an addition of 475,000 jobs originally reported for the previous month.

Data from the Commerce Department showed that the U.S. economy grew slightly less than expected in the fourth quarter of 2021. The Commerce Department said real GDP rose 6.9% in the fourth quarter, reflecting a modest downward revision from a previously estimated rise of 6.9%. 7%. Economists had expected GDP growth not to be adjusted.

Slightly slower than previously estimated GDP growth primarily reflected downward revisions in consumer spending and exports, partially offset by an upward adjustment to private inventory investment.

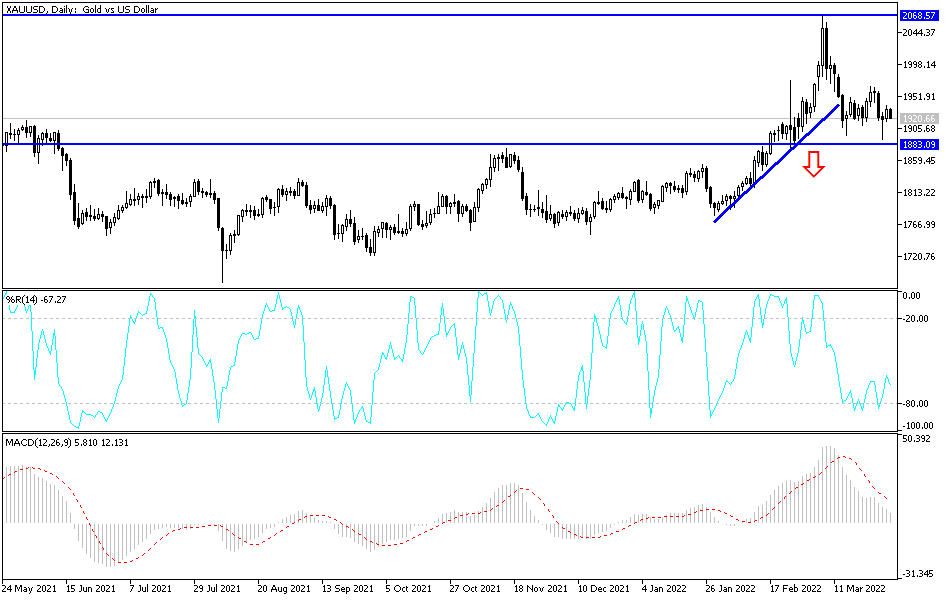

According to the technical analysis of gold: Global geopolitical tensions exist, and recently, the Corona outbreak re-emerged which affected after a period of rest for the markets to worry about it. I still prefer buying gold from every bearish level and the most appropriate levels to buy gold are 1880 and 1858 dollars, respectively. On the other hand, and as mentioned before, stability will remain above the resistance of 1900 dollars, motivating the bulls to dominate and increase technical buying deals. The closest targets for bulls are currently 1942, 1960 and 1975 dollars, respectively. The last level is important to move towards the psychological top of 2000 dollars.

The price of gold will be affected today by the price of the US dollar and the extent to which investors are willing to risk or not, as well as the reaction from the announcement of US economic data. In addition, most notably the jobless claims and the personal consumption expenditures price index reading, the Federal Reserve’s preferred measure for measuring US inflation.