The next logical target would be somewhere near the 4.50 BRL level, an area that has been important on longer-term charts.

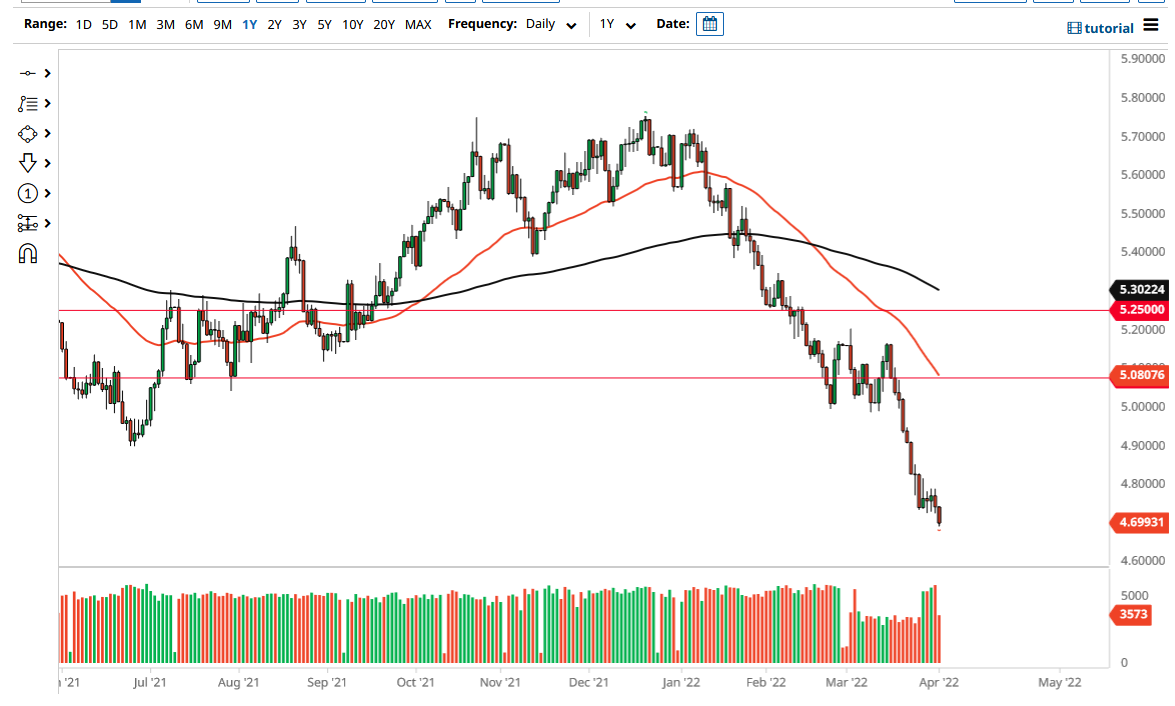

The US dollar has broken below the 4.70 BRL level during trading on Friday, as it continues to fall against a lot of emerging market currencies. At this point, the interest rate differential continues to favor Brazil, even though we have seen a massive move in the United States. The market has been in a significant decline for some time but then went sideways near the 4.75 level. It now appears that we are ready to continue going lower.

Latin American currencies can give great price movements.

Trade them with our featured broker.

Trade Now !

At this point, the next logical target would be somewhere near the 4.50 BRL level, an area that has been important on longer-term charts. Rallies will more likely than not end up being thought of as an excuse to start selling at the first signs of exhaustion, and therefore I do not trade rallies for anything other than a better entry to the downside. In fact, it is not until we break above the 5.08 real level that I would consider going long, and therefore I think what we are looking at is a situation where rallies will continue to get sold off.

The market has been rather nasty as of late, as you can see we have had a couple of very steep declines. It looks like we are going to continue that case, which in this market may not be as big of a surprise considering that it is a relatively thinly traded market. This is not like the Euro, which can spend quite a bit of time choppy and back and forth against the greenback. Because of this, this may fall further than we anticipated but like I said previously, the 4.50 level is an area where I think you would see a little bit of psychology come into the market.

The 50 Day EMA is crossing the previously mentioned 5.08 real level and is starting to go much lower, which of course is a bit disconcerting as well, as we have seen so much in the way of shorting. The Brazilian real of course is highly sensitive to soft commodities such as coffee and sugar, so pay close attention to those markets as you trade going forward. The US dollar continues to be very noisy against various currencies, showing a real mix of attitudes and appetite as far as risk is concerned.