Wait for a daily close in order to place a position because the intraday moves have been so violent.

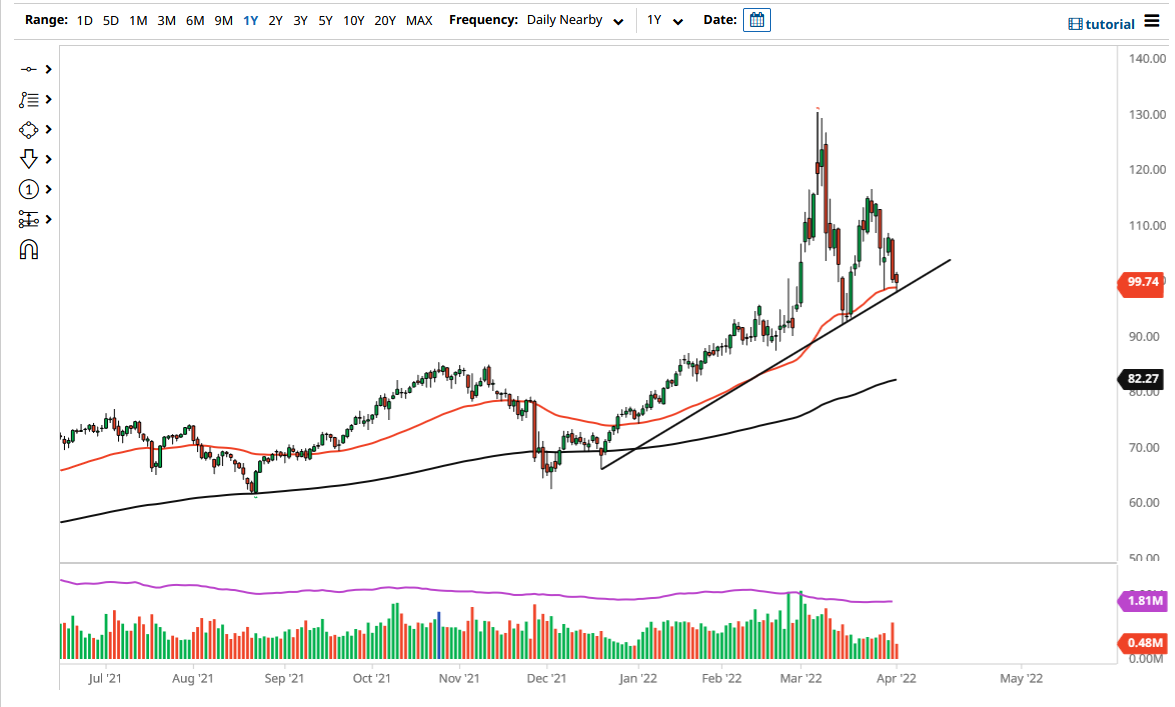

The West Texas Intermediate Crude Oil market has fallen a bit during the course of the trading session, reaching the 50 Day EMA during the session. At this point, the market continues to see a lot of support in that area, right along with the $99 level and the uptrend line. The market is certainly threatening a breakout, but at this point, if we can bounce it would be a good sign.

The West Texas Intermediate Crude Oil market has made a lower high, but it has not made a lower low yet. I think it is a scenario where we are trying to figure out whether or not this market is going to break down, or if it is simply going to continue the very volatile move to the upside. The volatility has been a sight to behold and is still very much a part of this market. Because of this, I believe that the market will be one where you have to wait for a daily close in order to place a position because the intraday moves have been so violent.

Keep in mind that there are many concerns out there beyond the war in Ukraine. For example, global economies are slowing down and that could bring down the idea of the demand for crude oil. We have also seen the Biden administration suggest that they are going to release 1 million barrels per day from the Strategic Petroleum Reserve, which could put a bit of a damper on pricing. Whether or not it works is a completely different question, but at this point, there are a lot of things going on that could come into the picture.

If we break above the $102 level, then we could go looking toward the $107 level above, which would be the most recent high. If we can break that, then the market is likely to go much higher. The market will continue to see a lot of back and forth, but it still has an upward tilt from what we can see so far. Ultimately, this is a market that has been so noisy as of late that it is very difficult to hang on to it with a large position. I would start with a small one, and then add as the market moves in your favor.