We expect the lira to decline.

USD/TRY Forex Signal

Risk 0.50%.

None of yesterday’s buy or sell transactions were activated

Best entry points buy

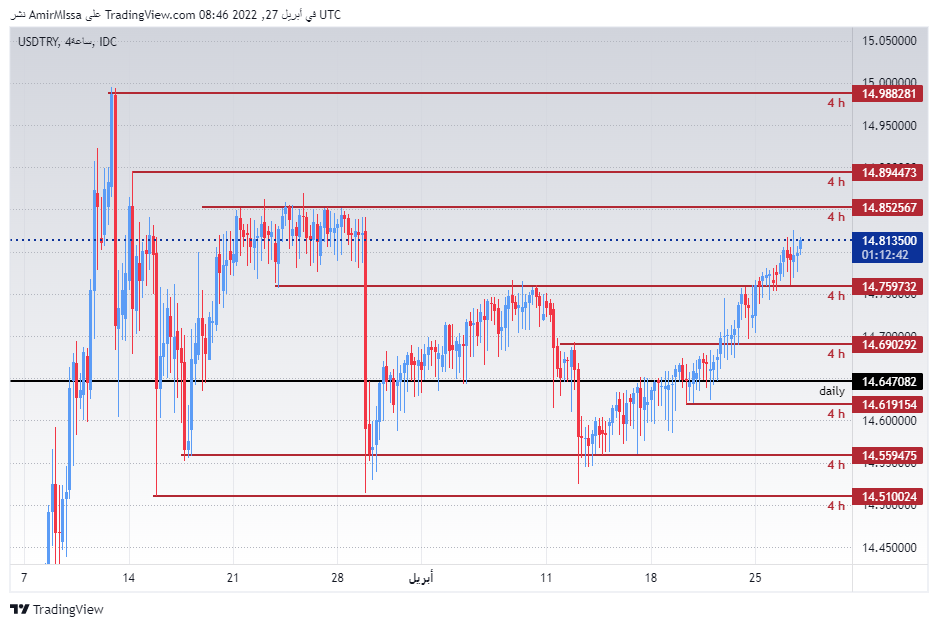

- Entering a long position with a pending order from 14.62 مستويات levels

- Set a stop loss point to close the lowest support levels 14.46.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 75 pips and leave the rest of the contracts until the strong resistance levels at 14.85.

Best selling entry points

- Entering a short position with a pending order from 14.85 levels

- The best points for setting the stop loss are closing the highest levels of 14.98.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 75 pips and leave the rest of the contracts until the support levels 14.40

The Turkish lira fell against the strong dollar as the pair recorded its lowest level in a month, with investors rushing the US dollar at the expense of most major currencies and currencies of emerging economies. The lira continued to suffer despite government efforts to collect the dollar and rely on the local currency in most of the internal transactions, as reports showed that the Turkish government had issued the use of the Turkish lira in transferable sales contracts compulsorily. The government also placed a ban on residents of the public and private sectors in Turkey from agreeing to their payment obligations or indexed in foreign currencies in the contracts concluded between them in relation to the sale and purchase of movable and immovable, and all types of movable and immovable leases and leases.

On the technical level, without major changes, the Turkish lira continued to decline slightly against the dollar during today’s trading, with trading continuing within a limited trading range. The pair is trading above the resistance line at 14.76 on the 240-minute time frame, shown on the provided chart. The pair also rose around the moving averages 50, 100 and 200, respectively, on the four-hour time frame as well as on the 60-minute time frame. The pair is trading the highest support levels that are concentrated at 14.76 and 14.60 levels, respectively. On the other hand, the lira is trading below the resistance levels at 14.85 and 14.89, respectively. We expect the lira to decline, especially after breaching the shown support level, as it targets 15.00 levels in the medium term. Please adhere to the numbers in the recommendation with the need to maintain capital management.