Expect a lot of volatility, but there is really no way to buy this market anytime soon.

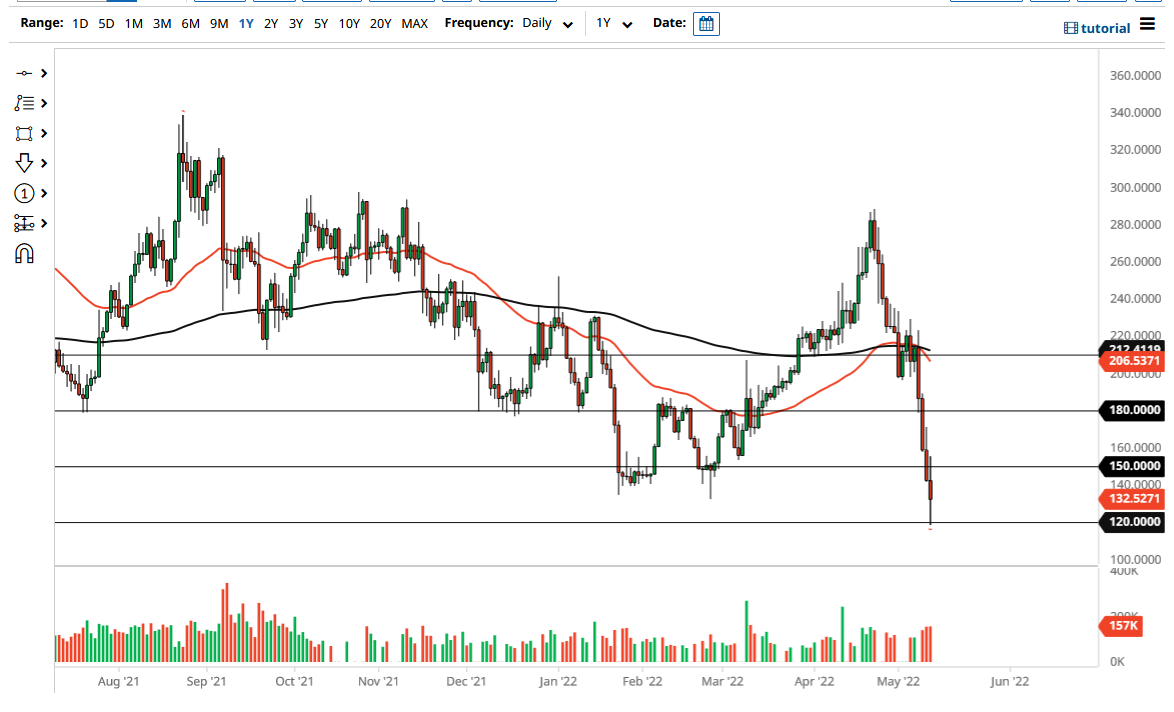

Monero has broken down rather significantly during the trading session on Thursday to reach all the way down to the $120 level. We have bounced from there, but quite frankly this is a market that has been negative for a reason, as Monero is pretty far out on the spectrum. Furthermore, as crypto is being shunned across the board, it is difficult to imagine a scenario where Monero suddenly is the Savior.

If we were to break down below the $120 level, then the market could collapse at that point, perhaps opening up a move down to the $100 level. The ferocity of the selloff does suggest that perhaps we are going to see a bit of a bounce, but I do not think it will last for any significant amount of time. In fact, I will be looking for some type of exhaustion after a bounce to get short again. The $150 level is perfect area to see this happen, so we will have to wait and see whether or not it actually gives us an exhaustion candle that we can take advantage of.

Even if we were to break above the $150 level, it is possible that we could go as high as the $175 level, which is the top of the Wednesday candlestick. The $180 level after that could offer significant resistance as well. It is not until we break above that level that I would be convinced that Monero is going to be going anywhere. Keep in mind that the US dollar is what the coin is quoted in, and the US dollar is like a wrecking ball at the moment. It is nowhere near rolling over, so therefore it is difficult to imagine most things being able to fight against the strength of the greenback, but there may be a little bit of profit-taking from short-sellers in markets like this.

Expect a lot of volatility, but there is really no way to buy this market anytime soon. I would be patient, and perhaps even wait until we get through the weekend to start shorting but it would take something miraculous to make this market something that I will be willing to buy. I know that some traders try to get cute with short-term charts and play the potential bounce. That is a recipe for disaster in a market like this.