Remember, bear market rallies tend to be violent.

The S&P 500 rallied a bit on Tuesday but still sits below a major resistance barrier. Furthermore, the Chairman of the Federal Reserve has already stated a very hawkish stance, so initially, we had a selloff as a reaction. However, Wall Street has found some type of narrative to hang onto, but at this point in time, it will only be a matter of time before the overall trend gets held onto.

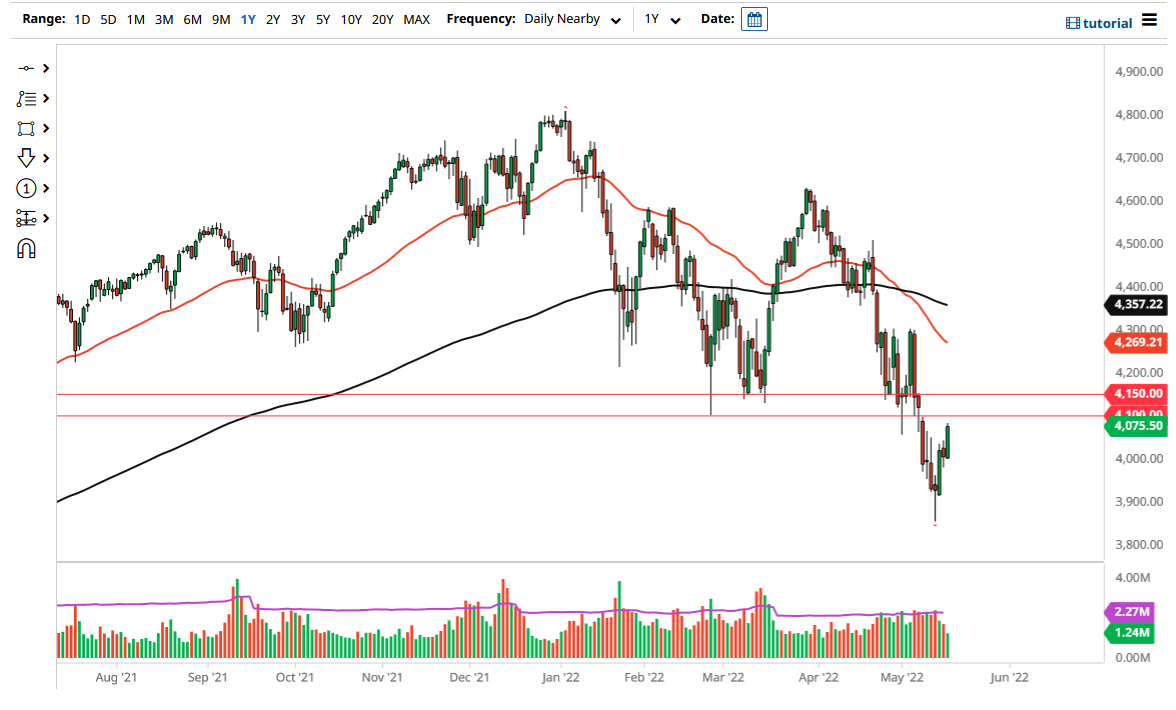

The 4100 level is resistance that extends to the 4150 level, as it is a “zone of resistance” based upon the market memory from its previous support. Signs of exhaustion in that area could be sold into, as this bounce has been rather strong, but it is also worth noting that we are in a strong downtrend, especially with the 50-day EMA breaking below the 4300 level. The 4300 level is an area where we have seen a lot of resistance as well, so I think we need to break through all of this to consider even remotely going long for a bigger move.

Keep in mind that interest rates in the United States continue to be very strong and it is likely that we will continue to see money run away from risk assets such as the S&P 500. The futures market of course does tend to be a little bit noisier than the underlying index, but either way, it is likely that we will continue to see a lot of volatility. At the first signs of exhaustion, I am more than willing to step in and start shorting this market. I have no interest in buying this market anytime soon, as I think there are far too many issues out there that will continue to cause major problems. Remember, bear market rallies tend to be violent.