Gold futures are struggling to stay in positive territory despite a stronger US dollar and higher Treasury yields. Despite swinging back and forth, gold prices are still on track to post tepid weekly gains. With the possibility of US inflation rising to 8% this next week, and the continuing war in Ukraine, the price of gold tested the level of $ 1950 an ounce today, and last week gold prices recorded a weekly gain of 0.4%, in addition to its 2022 annual gain to date, which is close to 6%.

As for the price of silver, the sister commodity of gold, it is trying to stay above $24.50. Overall, the price of the white metal fell about 0.7% last week, but it is still up more than 5% so far this year. In the end, gold has been trading relatively neutrally lately, despite the huge volatility across the global financial markets.

Commenting on the performance of the gold market, Craig Erlam, chief market analyst at Oanda, said in a research note, “Gold is trading around the same level it was yesterday, the day before that, the day before that, and so on, despite a sharp rise in volatility in places around the world. This is another result of the Fed’s hawkish shift, as gold was not affected. “We continue to see a consolidation in the price of the yellow metal, with the daily ranges tightening rather than widening as I expected,” the analyst added. “There are multiple forces at play here, but traders seem to be sticking with the traditional safe-haven inflation hedge.”

Last week, the minutes of last month’s Federal Open Market Committee (FOMC) meeting revealed that the Federal Reserve is preparing to be more aggressive in tightening monetary policy. The central bank plans to raise US interest rates beyond 25 basis points and shrink the balance sheet by $95 billion per month. Concerns are also rising about the strength of the economy. With the Federal Reserve poised to aggressively raise interest rates, the fear is that it will hit the brakes too hard or too quickly and push the US economy into recession. While that’s not the consensus on Wall Street, Deutsche Bank economists earlier said they expect a recession in the US by late next year.

The war in Ukraine has made matters even more uncertain by threatening to exacerbate inflation and damage the global economy. Oil, gas, and food prices have been particularly volatile since Russia invaded the country.

The price of gold is usually sensitive in a price environment because it increases the opportunity cost of holding non-return bullion.

The US dollar has seen a great performance over the past few days. The US dollar index (DXY), a measure of the performance of the US dollar against a basket of other major currencies, rose to 100.05, and accordingly the US dollar recorded a weekly rise of about 1.4%, which raises its rise since the start of the year 2022 to date to more than 4%. In general, a stronger profit is bad for dollar-denominated commodities because it makes them more expensive to buy for foreign investors.

Relative to the prices of other metals, copper futures rose to $4.73 a pound. Palladium futures rose to $2,410.50 an ounce. Platinum futures rose to $968.10 an ounce.

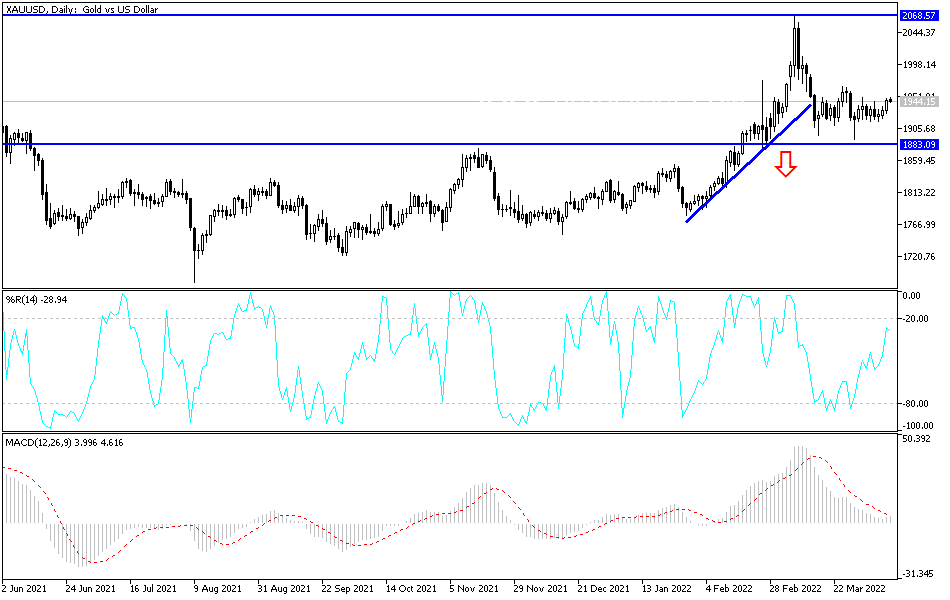

According to the technical analysis of gold: Every time that the price of gold tries to rise strongly, taking advantage of the continuation of global geopolitical tensions, it collides with the strength of the US dollar. This time the price of gold rose to the level of 1950 dollars an ounce, and we recommended last week to sell gold from that top with a target of support 1900 dollars for an ounce. It seems, according to the performance on the daily chart, that the price of gold may experience a price explosion in one of the two directions due to moving in narrow ranges for a long time recently.

According to the performance on the daily chart, the $1880 support will remain an important psychological point for a stronger and continuous control of the bears on the trend. At the same time, I still prefer buying gold from every descending level. On the other hand, bulls’ attempt to break the resistance of 1975 dollars over the same time period will support expectations of the near test of the historical psychological peak of 2000 dollars an ounce.