Ultimately, it’s easier to go higher than lower here.

The US dollar rallied a bit on Wednesday as we continue to see US dollar strength overall. That being said, the market continues to see a lot of noisy behavior in general, and it certainly looks as if the 0.98 level is going to cause some issues. If we can break above that, then it’s likely that the US dollar will go racing toward the parity level.

Keep in mind that this pair is a major divergence of central-bank policies, as the Swiss National Bank has no interest in trying to tighten, while the Federal Reserve most certainly will. However, the Swiss franc has a safety factor attached to it, so it’ll be interesting to see if investors continue to look to the US, or if they run toward Switzerland or safety. That being said, the market is likely to continue seeing a lot of volatility and concern out there, but it’s also worth noting that the US dollar is also a safe currency. In other words, it’s likely that we will see a lot of back-and-forth in this market, but ultimately it looks as if the US dollar is winning the battle due to the interest rate differential.

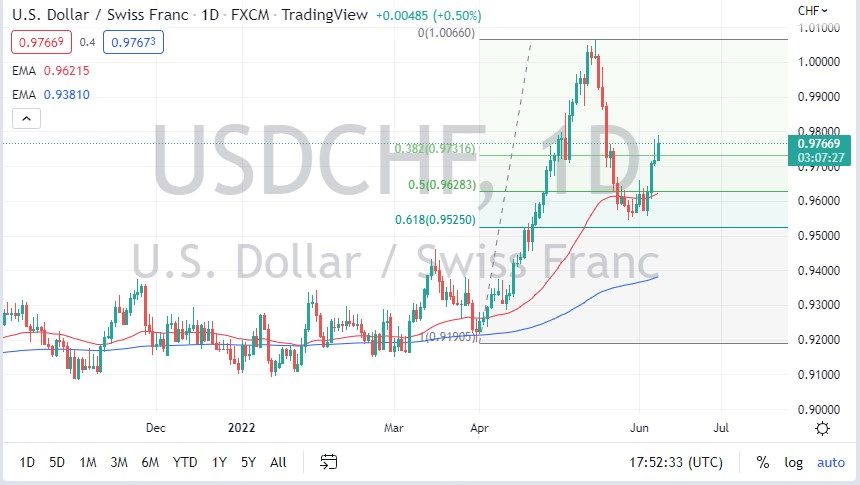

Underneath, we have the 50-day EMA that sits just above the 0.96 level, so it’s a very bullish sign and it makes sense that we would see that as a potential area of buying pressure. Ultimately, I have no interest whatsoever in trying to short this market, at least not until we break down below that level. It’s also worth noting that the 61.8% Fibonacci retracement level has offered support as well so that being said, the market looks as if it is trying to reach to the upside.

The US dollar continues to attract a lot of inflow, and with the 10-year yield over 3%, it makes sense that we will continue to see a lot of that in contrast with the Swiss who do everything they can to keep interest rates much lower. Because of this, I do believe that we will revisit the parity level, perhaps even an opportunity to break above there over the next couple of weeks. Ultimately, it’s easier to go higher than lower here.