[ad_1]

We need to pay close attention to the global slowdown, because if we do in fact see a lot of slowing down out there, it will have a major negative effect on the Aussie.

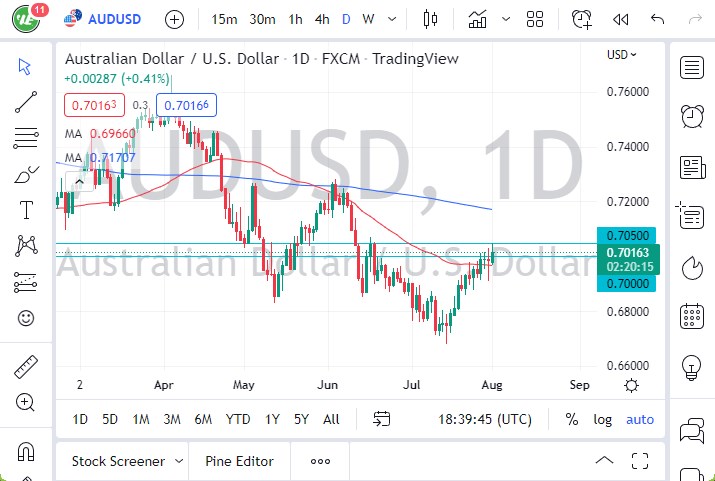

- The AUD/USD currency pair rallied significantly early on Monday but gave back quite a bit of the gains near the 0.7050 level.

- That’s an area that has been important more than once, so it’s likely that we will continue the overall downturn.

- Given enough time, I think that the Aussie will more likely than not break down below the 50-day EMA, and perhaps threaten the 0.69 level.

Breaking Through 0.69

If the 0.69 level is broken to the downside, that could open up a significant amount of selling pressure. At the 0.68 level, we may see a little bit of hesitation, but the real support is at the 0.67 handle. The 0.67 handle is a major area of support on the longer-term charge, so if we were to break down below the 0.67 handle, then it’s likely that the market could flush much lower, showing signs of a massive capitulation. This is an area that has been important multiple times in the past, so I think it would trip off a flood of selling.

Alternatively, if we were to turn out and show signs of life, a break above the 0.7050 level could send this market much higher. At that point, we could go looking to the 200-day EMA, which is close to the 0.72 handle. The 0.72 handle is roughly where the 200-day EMA sits, so I think it makes quite a bit of sense that we would see it as a target, and perhaps even resistance as well. Having said that, if we were to break above that level, then it’s likely that the entire trend would change. Because of this, the buyers would almost certainly overwhelm the market at this time.

The market is highly sensitive to the 10 year yield, as it is a major driver of what happens with the greenback. Furthermore, we need to pay close attention to the global slowdown, because if we do in fact see a lot of slowing down out there, it will have a major negative effect on the Aussie, as it is highly sensitive to commodity markets. In a significant recession, commodity demand drops through the floor, and then has an effect on the Aussie as the Australian economy is so highly sensitive to commodity exports, as it is the supplier for Asia.

Ready to trade our Forex daily analysis and predictions? Here are the best Forex brokers to choose from.

[ad_2]