[ad_1]

With the beginning of this important week’s trading, the price of the EUR/USD currency pair is trying to recover from last week’s sharp losses, which pushed it towards the 1.0836 support level. Today’s gains brought it to the 1.0916 level before settling around the 1.0880 level at the time of writing the analysis. Euro gains, as I mentioned before, will remain a target for sale as long as the Russian war lasts. After announcing the important minutes of the European Central Bank last week, the euro is awaiting this week’s monetary policy decisions by the bank amid strong expectations to keep European interest rates unchanged.

Minutes last week revealed that some members argued in favor of a definite end to the summer net asset purchase program, a necessary first step to raising the eurozone interest rate. Accordingly, analysts believe that the European Central Bank will seek to clearly distinguish between policy normalization and monetary tightening, explaining that normalization will include ending net asset purchases and returning the deposit rate to zero.

The tightening would be the start of a longer cycle of interest rate hikes, bringing prices close to or even above neutral levels (wherever these levels are). Normalization seems acceptable to both hawks and doves; There are only different views on timing. Emphasis is certainly not yet an option for doves, nor for all hawks.

Some analysts say it is “absolutely clear” that even the ECB hawks have asked for nothing more than a zero deposit rate by the end of the year. For example, ECB President Nagel suggested that interest rates may rise soon, but said the next decisions will be made by the ECB in June. As such, there shouldn’t be much rush to make more decisions at this week’s meeting, but the market is pricing in higher rates for the coming months, and that’s what ultimately matters for the euro exchange rates.

However, given that the ECB has surprised pretty tightly in each of the past few meetings, we see a risk that the central bank will make the decision to end net purchases by the end of June already at this week’s meeting, or at least give strength that it is leaning in this trend.

Any such consultative axis at this week’s meeting could provide more support for the euro, but of course a lot will depend on the overall investment climate related to the war in Ukraine.

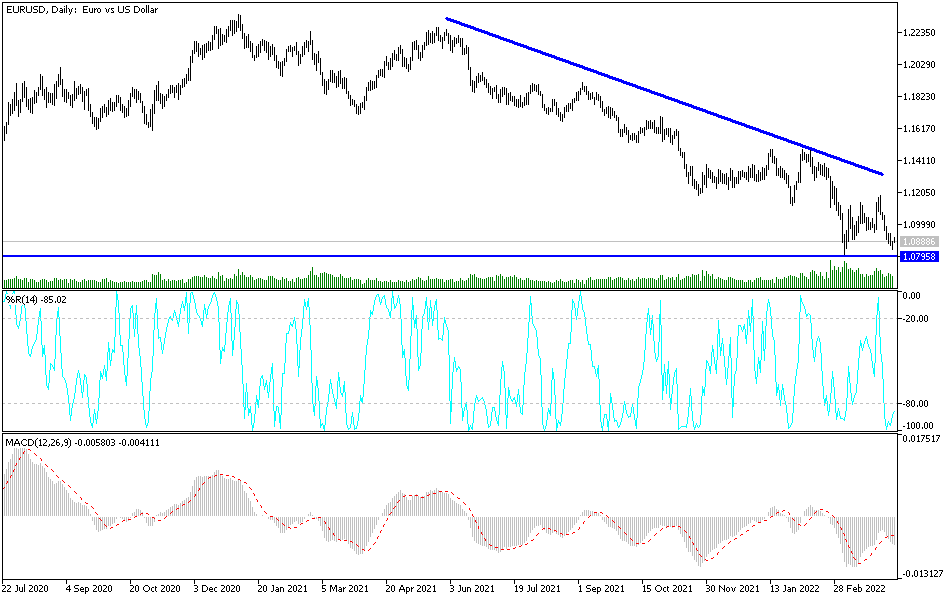

According to the technical analysis of the pair: The general trend of the EUR/USD is still bearish and any gains in the EUR/USD will remain a target for forex investors thinking of selling the currency pair. The optimum target for the bears currently is the psychological support 1.0800, which may increase the selling operations, despite the technical indicators reaching strong oversold levels, but the pressure factors on the euro are present and are represented in any case by the Russian war and its repercussions on the European and global economy. According to the performance on the daily chart, the 1.1200 resistance will be important in anticipating more strength.

Today’s economic calendar is devoid of any important US or Eurozone data, and therefore investor sentiment will be important in determining the currency pair’s fate today.

[ad_2]