[ad_1]

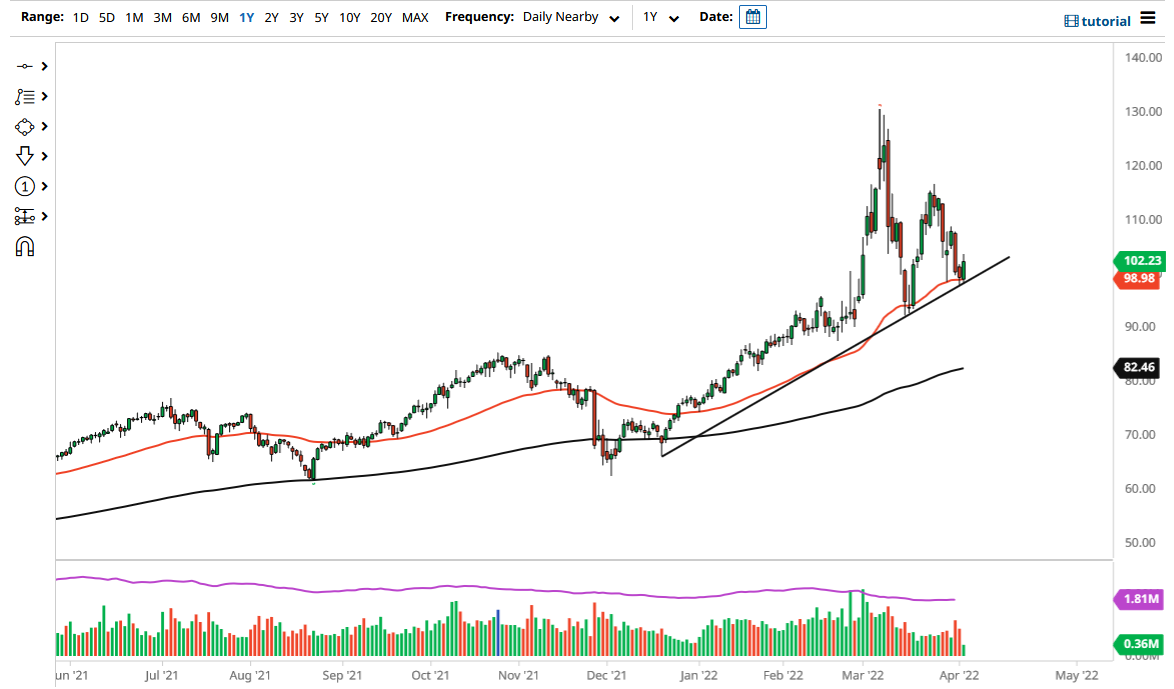

The West Texas Intermediate Crude Oil market has rallied on Monday to kick off the week on the right foot. It has bounced from the 50 Day EMA, which is an indicator that a lot of people pay close attention to, as it does tend to determine the overall short-term trend for longer-term traders. We also have the $100 level offering support, right along with the uptrend line that I have marked on the chart all culminating for buyers to bank on.

If we break above the top of the candlestick for the trading session on Monday, then it is likely that we go looking to reach the top of last week, which is right around the $109 level. Breaking above the $110 level then allows the market to go looking to the $115 level, which was the previous swing high. Taking that level out allows the market to go to the recent highs, near the $130 level.

Keep in mind that there are a lot of concerns out there when it comes to global growth, so that is weighing upon the price of crude oil, but we also have a market that has suffered at the hands of a lack of drilling and exploration, as the pandemic kept a lot of people out of the fields. Now that the rest of the world is starting to wake up, the oil markets are struggling to keep up with the huge amount of demand that suddenly appears. Whether or not that continues to be the case will be a completely different argument, because the cure for higher prices is always the same thing: higher prices. Eventually, things get so expensive that people start buying them.

The war in Ukraine has also had an effect, as huge swaths of Russian oil are not going to make the market anytime soon. Because of this, it does take a certain amount of oil off the market itself and creates a supply and demand imbalance. This is a market that has been in an uptrend for quite some time, so one would think that there will be plenty of momentum underneath to continue to push to the upside. Looking at this chart, we have seen a massive amount of volatility into the market, but it is worth noting that the buyers continue to return.

[ad_2]