[ad_1]

ADA/USD appears ready to begin the month of May near very troublesome lows, and if current support is proven vulnerable trading may grow more nervous.

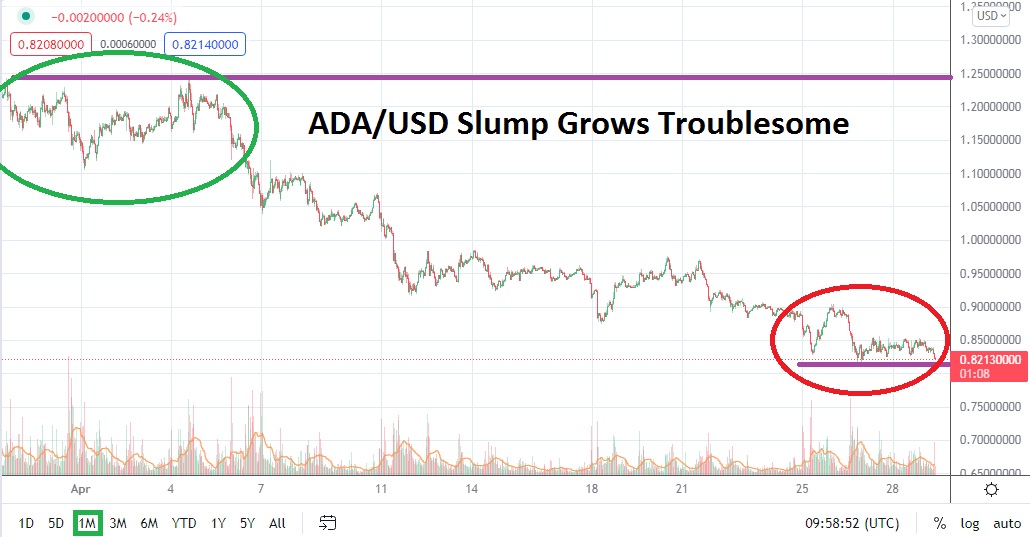

The month of April started out on an extremely positive note for Cardano. A high of nearly 1.25000000 was tested on the 4th and the high came within shouting distance of early February values. Traders who were bullish in early April could not have been blamed for believing the bearish trend was about to be brushed to the side, and that another strong leg upwards would be demonstrated.

Instead ADA/USD appears ready to begin the month of May near very unpleasant lows. The word ‘unpleasant’ is used as a polite way of saying the price of ADA/USD is approaching an ugly price level. As of this writing ADA/USD is traversing near 82 cents and mid-March values are again plainly in sight.

Having traded with a healthy dose of strength above the 1.20000000 mark in late March and early April, ADA/USD may have appeared ready to flirt with the solid higher values of early January 2022. But the highs of early April ran out of buying power, and now prices are languishing near crucial support levels which if proven vulnerable may cause more selling for Cardano. The 78 cents mark should be watched. Perhaps speculative bulls will feel that a price of this stature for ADA/USD represents oversold territory.

However from a technical viewpoint if ADA/USD were to brush up against this lower support vicinity seen in mid-March, speculative nervous selling could cause ADA/USD to traverse within values it has not seen since February of 2021. As May gets ready to start Cardano is not only at one month lows, but it is testing values not seen since the 16th of March. Day traders may be tempted to look for upside, but the trend has been lower. The push towards highs in early April appears for the moment to be a rally that ran out of power, as risk was taken off the table and perhaps profit taking flourished.

ADA/USD can provide traders with plenty of volatility and that may be attractive. Moves of five to seven cents within Cardano are not uncommon within a single day. Speculators need to make sure if they are going to participate in ADA/USD and pursue wagers that risk management needs to be firmly in place. While support levels may appear strong technically because of March lows and the reversals that occurred higher, the broad cryptocurrency market remains under a bearish shadow too.

Cardano Outlook for May:

Speculative price range for ADA/USD is 0.69000000 to 1.05000000

The current support level of 81 cents needs to be monitored, if this level fails to hold back the tide downwards, traders cannot be blamed for thinking mid-March values will be promptly tested. The 80 cents price may seem like an important psychological value, but there is little reason to think this mark can cause a widespread and sudden burst of buying if it is challenged.

Traders cannot be blamed for believing additional downside may be demonstrated by ADA/USD as new lows are created with a high rate of velocity. If the 78 cents level breaks this would be crucial and likely create more downside pressure. A low of 0.74750000 was seen on the 24th of February, if this support is not strong enough to withstand selling, traders will have to pull out long term charts from February of 2021.

Speculators who believe ADA/USD has been oversold exist. Day traders looking for reversals higher cannot be blamed, but they should stay realistic about their target prices as long as the bearish trend remains intact. If Cardano were to suddenly see strong buying and the 90 cents level tested and sustained, that could be an indicator another move higher could occur. However, until ADA/USD breaks its current trading range and maintains higher prices, traders may want to look at higher moves as an opportunity to sell into a cryptocurrency market which is still demonstrating nervous sentiment as they look for reversals lower.

[ad_2]