[ad_1]

As things stand right now, this market looks as if it will continue to be bought every time it dips significantly.

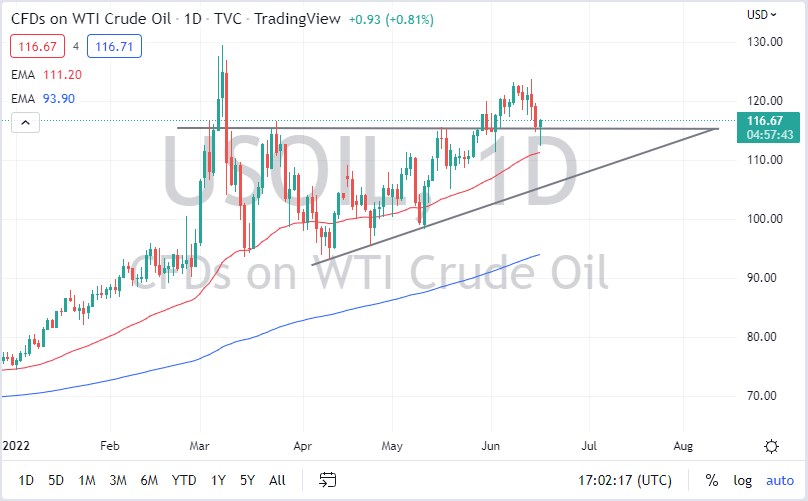

The West Texas Intermediate Crude Oil market initially fell during the trading session on Thursday as the market approached the crucial 50 Day EMA, and the $112 level. The market had broken below the top of the previous ascending triangle but has found enough buyers in that area to turn things around. In fact, it looks as if the market is going to continue to climb from here and perhaps go to the $120 level in the short term.

If we can break above the $120 level, then it’s likely that we will see this market attempt to get back to the $124 level, and further. The oil market has been very bullish for quite some time, and nothing has fundamentally changed the outlook for oil in the meantime. Yes, China locked itself back down, and that could in theory at least drive down a little bit of the demand. However, we spent the last two years not drilling, so it makes a certain amount of sense that we would see a serious imbalance in the markets. Furthermore, there’s still the problem in Ukraine with the war and the fact that a lot of Russian oil has been taken off the market.

At this point, it looks as if the oil market will continue to attract a lot of inflow, but it’s probably worth noting that it’s a very crowded trade. Crowded trades can have vicious pullbacks occasionally, so you need to be cautious on that front. That being said, the market is likely to continue going much higher, reaching the $130 level initially, perhaps even $135 over the next several months.

On the other hand, if we were to turn around a break down below the bottom of the previous triangle, that would be a very negative turn of events, by breaking through multiple support levels. In that scenario, I would anticipate that the WTI Crude Oil market would fall apart as everybody would be running through the exits at the same time. It’s very difficult to imagine that happening, but it is something that you need to keep in the back of your mind. As things stand right now, this is a market that looks as if it is one that will continue to be bought every time it dips significantly.

[ad_2]