[ad_1]

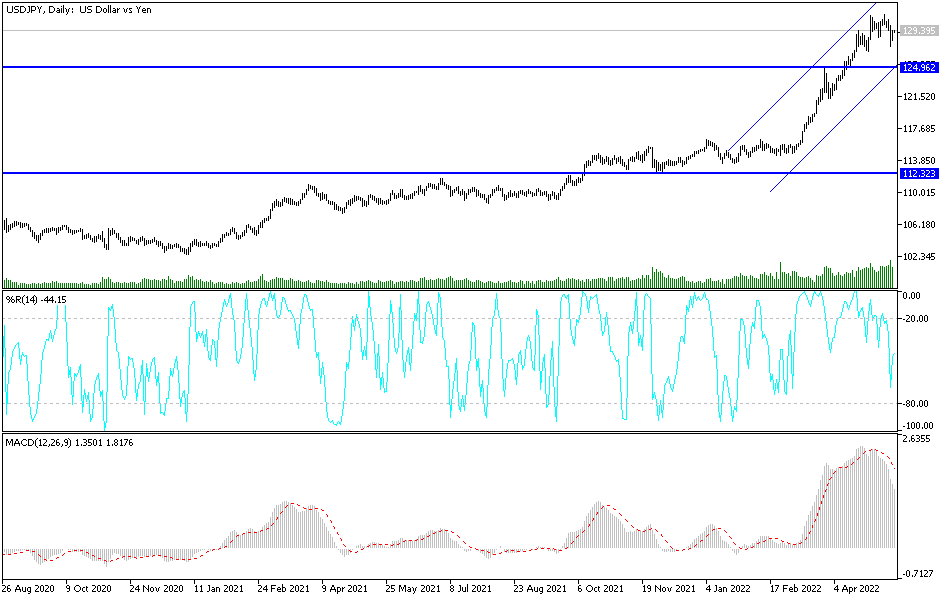

During last week’s trading, the price of the USD/JPY currency pair was exposed to profit-taking operations. It moved towards the support level 127.52 after the currency pair recorded its highest level in 20 years. As mentioned with the selling operations, forex investors may think of buying the currency pair as it returned to move towards the resistance level 129.45. The pair is stable near it at the beginning of this week’s trading. The US dollar is still supported by strong expectations of the path of raising US interest rates strongly during 2022.

Wall Street markets ended another volatile week of trading with a broad rally on Friday, although it wasn’t nearly enough to keep the market from its sixth consecutive weekly decline, the longest such streak since 2011. According to the performance, the S&P 500 rose by 2.4%. More than 90% of the companies listed in the benchmark index closed higher. The Nasdaq rose 3.8% as additional gains in technology stocks helped lift the index. The Dow Jones Industrial Average rose 1.5%.

Overall, the optimistic end still leaves indices with weekly losses of more than 2.4% each, extending the weekly series of declines to six weeks for the S&P 500 and Nasdaq, while the Dow recorded its seventh consecutive weekly decline. Markets have been tumbling since late March as investors fear that the Federal Reserve may not succeed in its delicate task of slowing the economy enough to rein in the highest rate of inflation in four decades without causing a recession.

While there were surprising gains along the way, including a 2.5% gain for the S&P 500 in late April and a 3% gain in early May, the market has continued to slide since hitting an all-time high at the beginning of May. This is not an unusual pattern on Wall Street when indices are close to entering a bear market, or down 20% or more from their most recent peak. The closest the S&P 500 index to a bear market this year was last Thursday, when it finished 18.1% below its January peak.

In general, companies struggle to keep up with the increasing demand for a wide range of products and commodities amid production and supply chain problems. They have raised prices on everything from food to clothing, which has been putting pressure on consumers and raising concerns about falling spending and slowing economic growth.

The Fed, for its part, is trying to dampen the effect of rising inflation by pulling the benchmark short-term interest rate from a record low near zero, where it has spent most of the pandemic. He also said that it may continue to raise interest rates by twice the usual amount in upcoming meetings. Investors worry that the central bank could cause a recession if it raises interest rates too much or too quickly.

The Ministry of Labor issued reports this week confirming persistently high consumer and wholesale prices affecting businesses. Meanwhile, China’s decision to shut down major cities amid concerns about a resurgence of the coronavirus has further strained supply chains, and Russia’s invasion of Ukraine has pushed up already high energy and food costs globally.

According to the technical analysis of the pair: The return of the price of the US dollar against the Japanese yen to stability above the 130.00 psychological resistance. The bulls will restore the momentum to return to the move towards record ascending levels again. The closest resistance levels for the currency pair are currently 130.00, 130.85 and 131.35, respectively. On the other hand, according to the performance on the daily chart, breaking the support 126.40 will support the bears to move downwards, and at the same time, it will be an opportunity to think about buying the currency pair again.

[ad_2]