[ad_1]

Our expectations suggest a decline in the index during its upcoming trading.

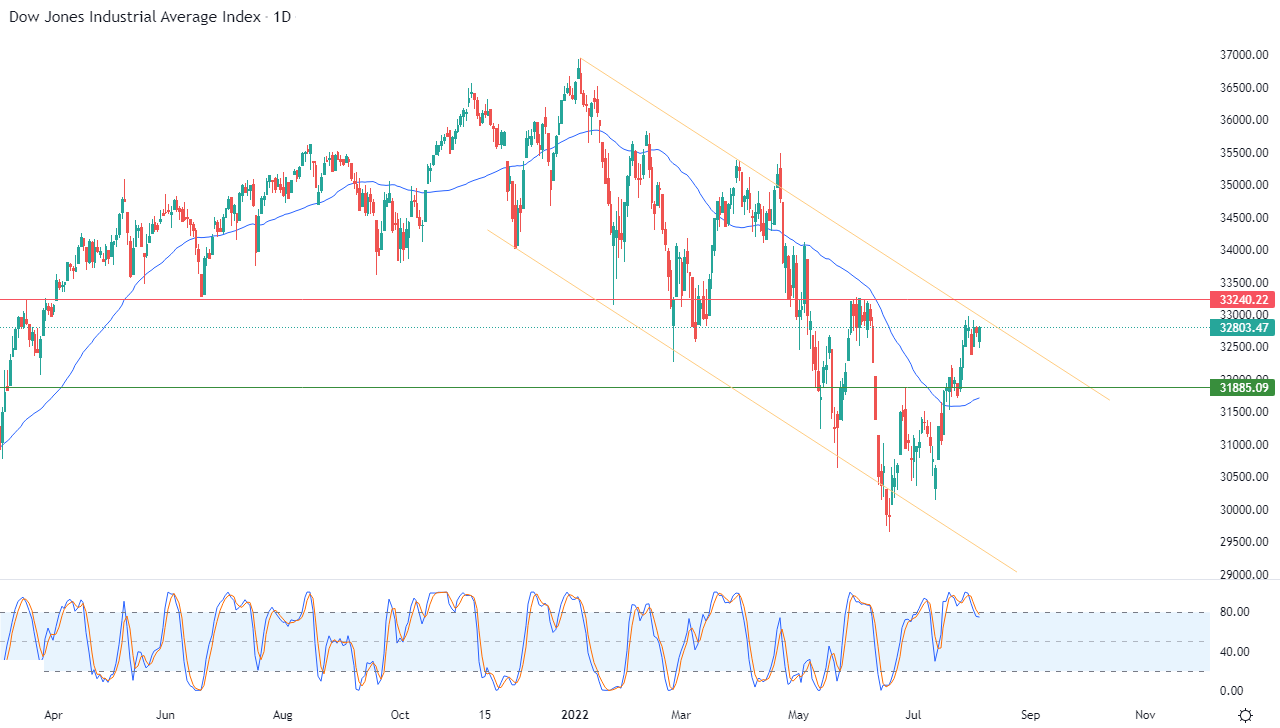

The Dow Jones Industrial Average rose during its recent trading at the intraday levels, to achieve gains in its last sessions by 0.23%, to gain about 76.65 points. It settled at the end of trading at the level of 32,803.47, after its decline during Thursday’s trading by -0.26%, in last week, the index declined slightly by -0.13%.

Current volatility is making great stock trading opportunities – don’t miss out!

The US employment report showed an increase of 528,000 in non-farm payrolls in July, exceeding estimates of an increase of 250 thousand jobs, compared to a 398,000 increase in June. While the unemployment rate fell to 3.5%, versus estimates of no change of 3.6% in a Bloomberg survey.

Average hourly earnings rose 0.5%, stronger than the upwardly revised 0.4% increase in June, while maintaining the adjusted annual rate at 5.2% compared to expectations of a slowdown to 4.9%.

The unemployment rate has returned to its pre-pandemic lows and hourly wages have risen. Announcements of layoffs by a number of prominent companies had earlier raised fears that a strong labor market could be waning, opening the door to stronger expectations of an interest rate hike from the Federal Reserve accepted, as part of its attempts to rein in inflation, which reached its highest level in 40 years.

Some analysts argue that the strong jobs data reinforces the notion that the economy can withstand the Fed’s monetary policy tightening without falling into a recession. Meanwhile, sharp declines in commodity prices, including oil, helped support the notion that inflation may be approaching its peak.

Technical Analysis

Technically, the index moves within the range of a bearish corrective price channel that limits its previous trading in the short term, as shown in the attached chart for a (daily) period. This is with the influx of negative signals on the relative strength indicators, after they reached areas of severe overbought operations. The index benefits from positive support due to its continuous trading above its simple moving average for the previous 50 days.

Therefore, our expectations suggest a decline in the index during its upcoming trading, as long as the pivotal resistance level 33,240 remains intact, to target the support level 31,885.

Ready to trade the Dow Jones in Forex? Here’s a list of some of the best CFD brokers to check out.

[ad_2]