[ad_1]

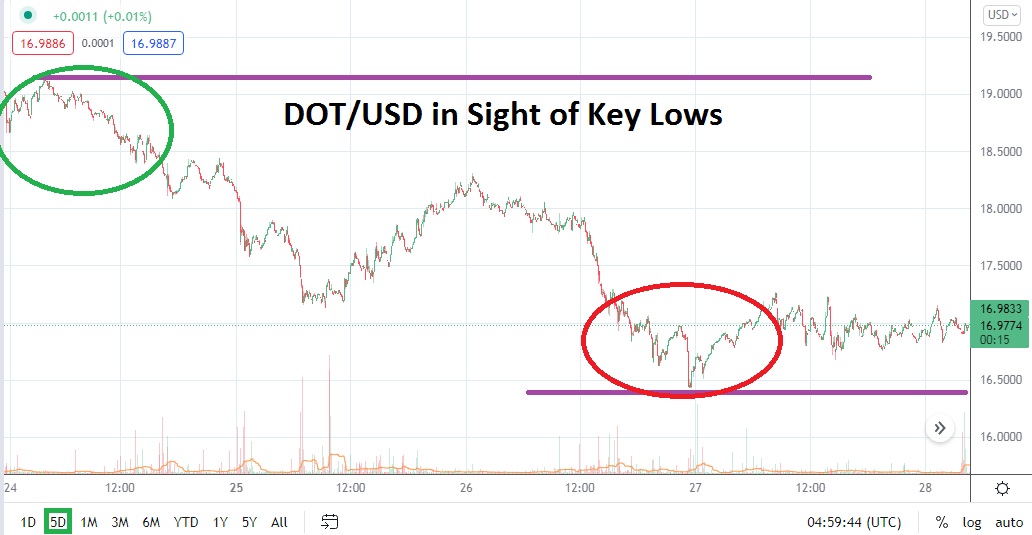

DOT/USD has taken another turn lower and is clearly within sight of important support levels, which speculators may consider critical inflection points.

DOT/USD is trading below the 17.0000 mark as of this writing and if the cryptocurrency cannot rise and sustain its value over this level, this inability may set off alarm bells among speculators. On the 21st of April DOT/USD had climbed to nearly 19.7000 after testing lows slightly above the 17.0000 mark for a handful of days before. Yesterday’s trading took DOT/USD below the 16.5000 ratio momentarily, which challenged values not seen since the 8th of March.

The broad cryptocurrency market remains nervous and Polkadot is certainly mirroring the rather weak results as support levels considered critical are being monitored in many digital assets. DOT/USD was able to reverse higher after hitting its lower values on Wednesday, but the buying has not been exuberant and traders who believe more downside action could develop are likely watching. If DOT/USD starts to make support near the 16.9000 and 16.8500 prices appear ready to falter, it is conceivable that 16.7500 to 16.5000 would become legitimate targets.

While bullish traders may believe upside reversals can be attained, they may want to stay rather cautious and not look for over ambitious results higher. The short term has shown plenty of resistance above, and the 17.2500 mark almost feels far away in early trading. However, if this relatively close resistance mark is penetrated, traders may feel obligated to wager on further upside to the 17.4500 to 17.5500 ratios. It does appear any move above 17.7500 in the short term would be rather surprising.

DOT/USD is currently fighting for equilibrium below 17.000 and if the cryptocurrency continues to traverse near these critical lows and again moves towards yesterday’s depths, this would be a negative signal. If the lower values are flirted with in the short term, it could mean a significant test of values not seen since the first week in March are about to be exhibited.

Cautious traders may believe downside pressure is going to continue and want to wait for some upside movement before igniting their short positions. However, if DOT/USD lingers near its current price of 16.9500 and lower, than it may be worthwhile to look for downside momentum sooner rather than later. The trend downwards in DOT/USD has been rather consistent. Traders should use conservative amounts of leverage and stop losses, but wagering on lower prices in DOT/USD may be the logical decision near term.

Polkadot Short-Term Outlook

Current Resistance: 17.2100

Current Support: 16.5200

High Target: 17.8700

Low Target: 15.8100

[ad_2]