[ad_1]

Investors’ reaction to the future of raising interest rates increased during the year last week, as the European Central Bank finally indicated the imminent date of tightening its policy to face the hyperinflation, even if it was quite late steps from what the US Federal Reserve wanted. Accordingly, it found the price of the euro currency pair against the US dollar In the cautious recovery, towards the resistance level 1.0936. The pair quickly returned to move within the broader general trend, which is the bearishness, and fell to the support level 1.0770 by the end of the week before closing trading stable around the psychological support level 1.0800. This still confirms the strength and control of the bears on the trend and warns of a stronger downward move. This is possible as long as the US central bank is the strongest signal from the European Central in the pace of raising interest rates and as long as the Russian-Ukrainian war continues.

Outlook for the EUR/USD pair: The euro may fall to the dollar level, or rise again to the 1.15 level according to Italian lender UniCredit which sees one of two scenarios in action over the coming weeks. UniCredit says that significant uncertainty across markets means there is now a need to focus on “extreme scenarios” pursued by the European Central Bank (ECB).

Accordingly, the ECB can either:

1) Decides to roll back plans for “normalization” (i.e. move towards higher interest rates) in the face of a complete stagnation in the Eurozone.

2) Raising interest rates to get inflation back on track.

Says Roberto Mialic, FX analyst at UniCredit in Milan, “In a pessimistic scenario, the ECB backs away from normalization plans to tackle a systemic stagnation across the eurozone even in the face of inflation approaching 10%, while in a hawkish scenario, it becomes European Central Bank tied, raises deposit rate to 2.0 -2.50%.”

Hints that the ECB is looking to tighten policy were provided by a group of ECB Governing Council members last week who all pointed to the need to raise interest rates before the end of the year. Notable among them was ECB Vice President Luis de Guindos who said a rate hike by July could be fun.

The euro exchange rates rose in response to the apparent “hawkish” turn of the European Central Bank.

Under the hawkish scenario, UniCredit sees the ECB push the deposit rate 100 basis points beyond the 1.50% peak now being priced by markets over a two-year period. Therefore, the analyst adds, “The regression analysis indicates that the shift caused by the interest rate differential between the ECB deposit rate and the target rate for the fed funds will be consistent with the rebound of the euro against the US dollar towards 1.15.”

The war in Ukraine continues, creating headwinds for the European Union through rising energy prices and a recession in the eurozone cannot be ruled out if the war and associated sanctions intensify. The analyst adds, “In the pessimistic scenario, the European Central Bank abandons its plans to normalize policy and may consider expanding its asset purchases, thus depriving the euro, which has likely slowed the pace of its decline against the US dollar so far.” On the forecast for the euro, the analyst says, “EUR/USD up and down 1.08 as a reflection of fluctuations in long-term spreads in the European Union and the United States.” “Removing these brakes is likely to accelerate the pair’s decline towards parity, with the 1.05 level as an intermediate target,” he adds.

However, the European Central Bank would be reluctant to accept such a significant depreciation of the euro because such a decline is likely to lead to a higher cost of energy imports, exacerbating the problems of the eurozone. We were informed on Friday that there are signs that the ECB’s latest hawkish pivot may indicate that it is watching the currency. The European Central Bank is trying to “curb inflation expectations and the euro’s decline.”

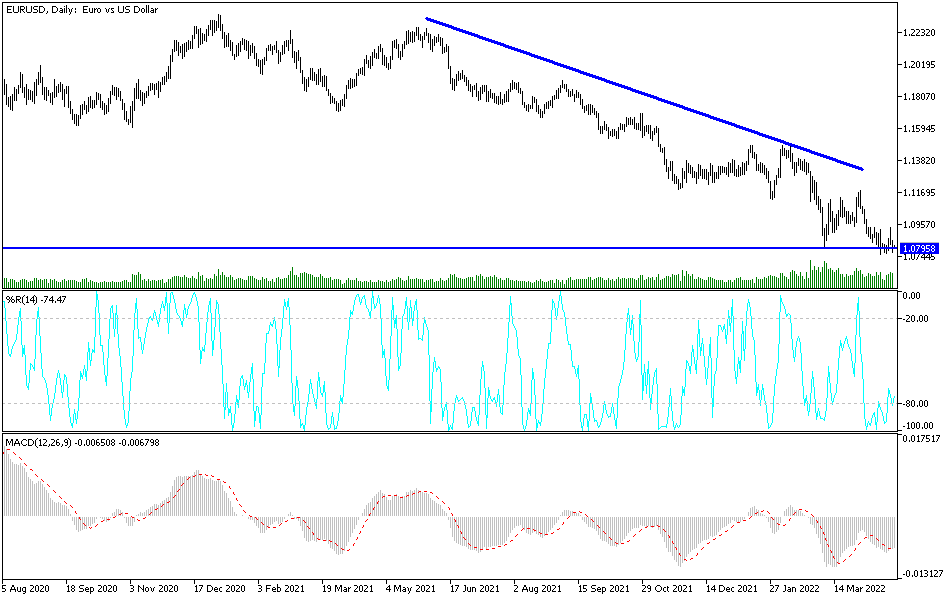

According to the technical analysis of the currency pair: In the near term and according to the performance of the hourly chart, it appears that the EUR/USD is trading within the formation of a descending channel. This indicates a significant short-term bearish bias in market sentiment. Therefore, the bears will look to extend the current declines towards 1.0771 or lower to 1.0732. On the other hand, the bulls will target potential recovery profits at around 1.0819 or higher at 1.0852.

In the long term and according to the performance on the daily chart, it appears that the EUR/USD is trading within the formation of a descending channel. This also shows a long-term bearish bias in market sentiment. Therefore, the bears will look to maintain long-term control of the pair by targeting profits at around 1.0669 or lower at 1.0536. On the other hand, the bulls will target long-term profits at around 1.0929 or higher at 1.1082.

[ad_2]