[ad_1]

I expect the EUR/USD price to keep moving in narrow ranges until the monetary policy decisions of the US Federal Reserve are announced. Since the start of this week’s trading, the EUR/USD price has been in a narrow range between 1.0178 and 1.0258, and is settling around 1.0220 at the time of writing the analysis. Overall, the upcoming FOMC decision is likely to be the biggest catalyst for the most popular currency pair in the forex market, as the divergence between the policy of the US central banks and the eurozone pushes the euro against the dollar lower.

Another US interest rate hike of 0.75% to 1.00% is expected from the Federal Reserve, and the outlook alone may be enough to push the dollar higher across the board before a decision is made. Profit taking can be observed during the actual event, especially if the Fed makes clear that it is concerned about stimulating a recession. A few days ago, the European Central Bank also introduced a larger-than-expected rate hike, but investors seem to think that this was a bit too late.

What will happen to the Euro today?

The EUR/USD exchange rate rebounded resoundingly last week and could try to reverse further declines this month and in the coming days if the Fed leaves the US currency hanging on Wednesday and it all moves well for the single currency on the European data front.

The single European currency, the Euro, received a late rally last Friday after the S&P Global PMI surveys indicated that activity in the most important services sector in the US may have fallen faster than the manufacturing sector in Europe during July.

This saw EUR/USD recover above 1.02 resistance before the weekend and in price action that was implying that the forex market is asking itself whether the Eurozone economy is lagging far behind its North American counterpart in the opening month of the third quarter.

Commenting on performance and stress factors. Says Jane Foley, forex analyst at Rabobank, who wrote in the wake of last week’s rate hike from the European Central Bank. “We have revised down our EUR/USD forecast and see the risks that the exchange rate could drop as low as 0.95 during the summer months. We expect the strength of the US dollar to ease broadly early next year allowing the EUR/USD to recover to the 1.05 region over the course of 6 months.” While the euro price on Friday benefited from the bleak message of the latest US business surveys, local economists have become more pessimistic about the European economic outlook recently and analysts’ expectations for the euro/dollar rate are falling increasingly lower.

EUR/USD Forecast:

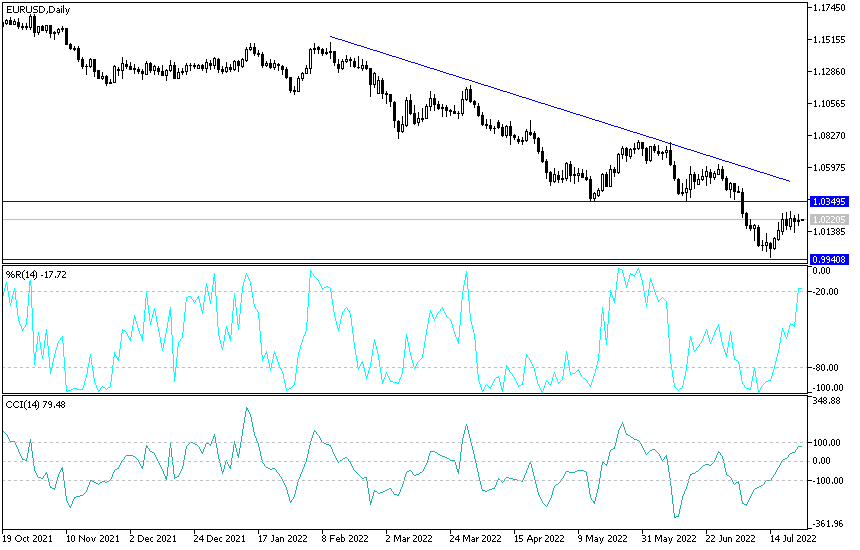

The EUR/USD pair continues to descend within the descending channel on the long-term time frames. Since then, the price bounced off the support and rose to the 38.2% Fibonacci retracement level. This also happens to line up with the middle of the channel around the 1.0200 resistance, adding to its strength as resistance. A higher retracement could reach 50% Fibonacci near the 200 SMA, dynamic resistance at 1.0300 or 61.8% Fibonacci near the channel top at 1.0400.

So far, the 100 SMA is still below the 200 SMA to confirm that the general trend is still down and selling is more likely to resume than reverse. The price is currently testing the dynamic resistance at the 100 SMA. Stochastic appears to be moving downwards to confirm that selling pressures play a role, and the oscillator has little room to move down before reaching the oversold area. The RSI has more room to go lower before it reflects exhaustion among sellers.

In this case, EUR/USD could fall to the swing low at parity or 1.0000 thereafter. A break below this key level could mean a sharper decline for this pair.

Ready to trade our daily Forex forecast? Here’s a list of some of the best Forex brokers to check out.

[ad_2]