[ad_1]

Amid the continuation of record bearish pressure for the EUR/USD currency pair, investors and markets in general are preparing for an important and historic trading week. The US Federal Reserve will raise interest rates according to expectations by half a point, and it may be amazing to do more than that in this week’s meeting. This path often helped the US dollar to achieve record gains, which brought it, along with the euro-dollar pair, to the 1.0470 support level, the lowest in five years, and it will start trading this important week by stabilizing around the 1.0546 level.

The EUR/USD exchange rate is set for its biggest one-month drop since March 2015 after another week of accelerating losses, and research by Barclays Bank indicates that it is the risks to European energy supplies that have made the single European currency at “low levels”. The performance of the EUR ignored Eurostat figures which showed inflation in food and non-energy prices rose sharply during the month of April after the economic performance was slower than expected in the first quarter.

The price of the euro against the dollar was still bearing heavy losses during the trading week and was on its way to achieve its largest loss in one month since shortly after the European Central Bank (ECB) first started quantitative easing during the first months of 2015. “In our March forecast, we set a forecast path that allowed some moderate downside for EUR/USD in the near term, to 1.09,” said Themistocles Futakis, Head of FX Research at Barclays Bank. But this quick slide in April to 1.06, despite recognizing a host of catalysts that we thought would boost the euro, was beyond our expectations.”

The Euro’s losses increased rapidly after reports that Russian gas supplies to Poland and Bulgaria had been halted.

Both have reportedly refused to comply with the terms of a Kremlin decree requiring them to open accounts with Gazprombank in which euro-denominated payments for Russian gas are converted into rubles in Moscow and by state-owned energy giant Gazprom.

The recent power outage was followed by potentially false market speculation that the same factors noted above may soon lead to other European countries also cutting off Russian gas pipelines, which will be a significant event for the Eurozone economy. Many economists predict that any abrupt interruption of energy supplies would hamper economic activities and create great difficulties for businesses and households, which is why energy has not been targeted as part of any European sanctions due to the Russian invasion of Ukraine.

According to Barclays experts, “There are certainly other technical forces in the near term at work. For example, the US dollar is naturally more effective than the euro for domestic cyclical forces than for global forces. As such, the depreciation of the Chinese yuan is driven by the fact that, relative to other factors, the growth shock from China’s COVID policies has a more profound impact on the euro.”

“But even so, this is the shock of COVID. And as we’ve seen, COVID order damage tends to be corrected by a compensating increase on reopening. In this sense, we will not chase the EURUSD to fall from very cheap levels based solely on the COVID shock. With that said, a disruption to natural gas flows due to Russian ruble payments would be even more disruptive to the euro.”

Barclays’ latest forecast released in March looked for EUR/USD to trade near 1.09 during the second quarter, effectively bottoming out a downtrend that started in January 2021 before giving way to a recovery back towards the 1.15 handle by the end of the year. So far, Barclays has not deterred these expectations, but has warned clients that if the ban or any other factor disrupts gas supplies to Europe, it will “meaningfully revise our outlook for the euro against the dollar”.

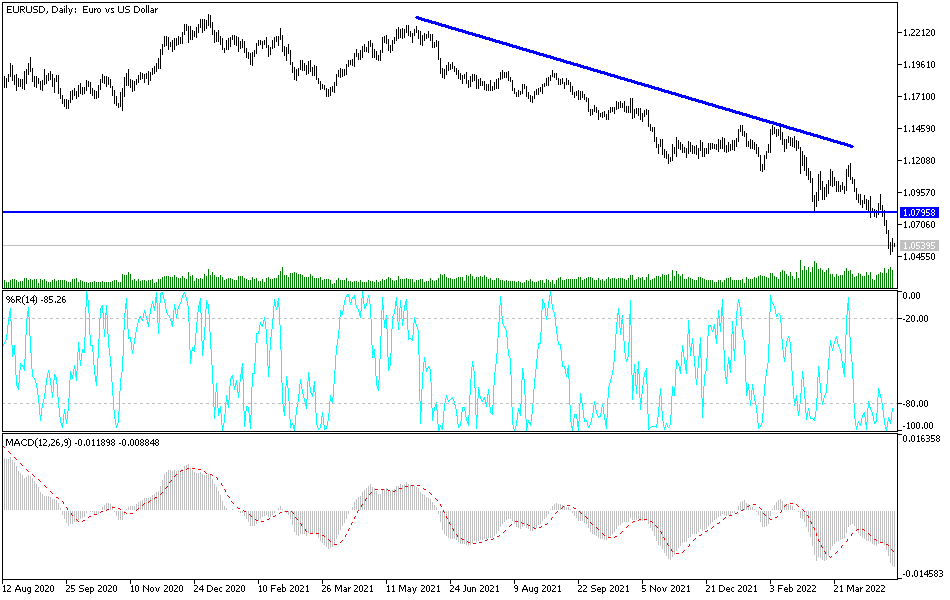

According to the technical analysis of the pair: In the near term and according to the performance of the hourly chart, it appears that the EUR/USD is trading within the formation of a relative bullish channel. This indicates a significant short-term bullish bias in market sentiment. Therefore, the bulls will target short-term gains at around 1.0573 or higher at 1.0611. On the other hand, the bears will look to pounce on a potential pullback at around 1.0510, or lower at 1.0472.

In the long term and according to the performance on the daily chart, it appears that the EUR/USD is trading within the formation of a sharp descending channel. This indicates a strong long-term bearish bias in market sentiment. Therefore, the bears will look to ride the current series of declines towards the 1.0384 support or lower to the 1.0231 support. On the other hand, the bulls will look to pounce on long-term profits around the 1.0707 resistance or higher at 1.0871.

[ad_2]