[ad_1]

The downward trend of the EUR/USD currency pair is continuing. This path pushed the most popular currency pair in the forex market to the 1.0514 support level, the lowest in five years, and settled around the 1.0555 level at the time of writing the analysis.

The decline continued amid investor concerns about growth and threats to energy supplies from Russia. The single European currency, the euro, tumbled past the lowest level it reached in the first weeks of the coronavirus pandemic in March 2020, after Russia said it would cut gas to Poland and Bulgaria. There is now a possibility that the euro will close in April without its 20-year bullish trend, which could put parity with the dollar on the horizon.

In contrast, gains in the dollar accelerated and Russia’s arming of energy exports add to headwinds for the European currency, including the European Central Bank’s relatively more cautious stance on monetary tightening than the US Federal Reserve.

Traders, who requested anonymity because they are not authorized to comment on the forex foreign exchange market publicly, said that the currency’s decline since the New York close saw significant momentum in sell orders below the target low.

The European Union has rejected its demands to pay for Russian gas in rubles, but deadlines are now running out and governments need to decide whether to accept Russian President Vladimir Putin’s terms or lose vital supplies. Concerns about global growth caused by the worsening virus outbreak in China also boosted the dollar at the expense of the single European currency.

On the future performance of the euro-dollar: Some analysts are of the opinion that a depreciation of the euro-dollar exchange rate could move it close to it, or achieve 1:1.

The Eurozone energy shock intensified in the last hours after news emerged that Russia would suspend gas supplies to Poland and Bulgaria. The reason Russia cited was the two countries’ failure to comply with their demand to pay for gas in rubles. For its part, Poland says it was prepared for this possibility, but indicates that Russia is increasingly ready to arm its energy exports. According to the performance, the exchange rate of the euro against the dollar fell from its highest levels near 1.15 before the outbreak of the war in February to 1.0515 today, as analysts say that the war poses significant threats to the growth of the euro area and the European Union.

Jeremy Bolton, market analyst at Reuters, says the chance of EUR/USD falling below parity is greater now than it was during the eurozone debt crisis in the early 2000s. Bolton added, “Demand for the dollar resulting from significant tightening in US monetary policy is likely to lead to a larger decline than in 2015 when bets on the end of the single European currency drove traders into a record sell-off and the pair fell to 1.0457.”

The analyst notes that the current betting shows traders are “gambling high” — confirming the view that the parity decline is not crowded. And when sites get crowded, it’s actually a headwind for movement, but when the market is relatively uncrowded, the “clear air” ahead of you allows the trend to extend. “In 2015, the policies of the European Central Bank were designed to save the euro. The current policies are weighing on them and there is the potential for a bigger disagreement with the Fed, not only to raise interest rates in a big way but also to reduce the balance sheet. This could push the EUR/USD pair much lower.”

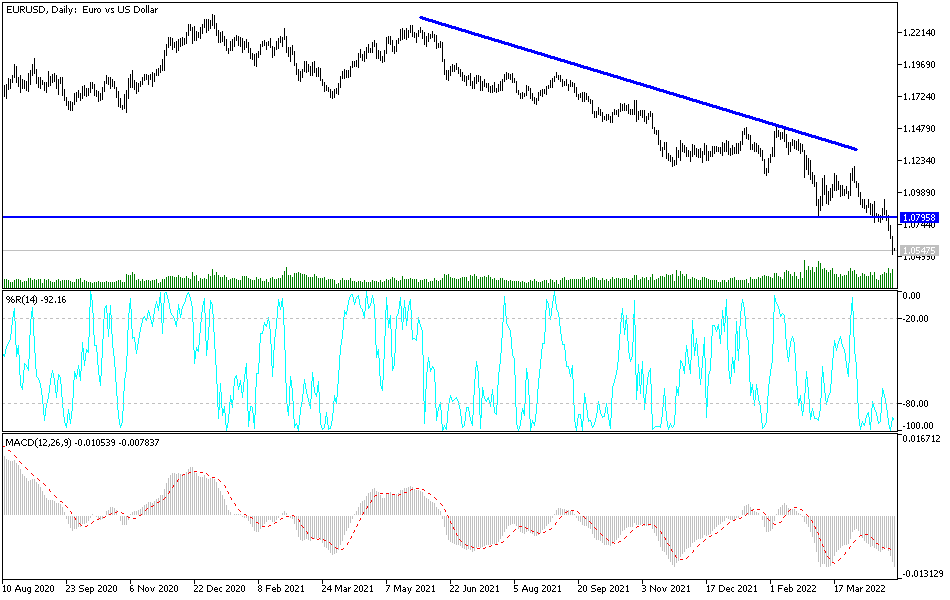

According to the technical analysis of the pair: So far, the general trend of the EUR/USD currency pair is still bearish. As mentioned before, the continuation of the weakness factors supports the current trend, the most prominent of which is the continuation of the Russian war and its repercussions. It is also in addition to the position of central banks towards tightening their policy, and the US Federal Reserve is leading this. Forex traders do not care about technical indicators reaching oversold levels and the persistence of weakness factors that open the way for a level test.

The bearish trend is stronger and the closest to it is currently 1.0500 and 1.0380, respectively.

On the upside, and according to the performance on the daily chart, the EUR/USD pair needs to break the psychological resistance currently 1.1000. Otherwise, the trend will remain bearish, and I still prefer to sell the EUR/USD from every ascending level. The euro-dollar pair is awaiting the announcement of German inflation figures, then US economic growth figures and weekly jobless claims.

[ad_2]