[ad_1]

During the middle of this week’s trading, the price of the EUR/USD currency pair is subjected to selling operations. As mentioned before that this may be very likely as the markets prepare for the reaction from the announcement of the US jobs numbers. This is in addition to the continuing strong threat to the energy future in Europe, increasing global geopolitical tensions, and the dollar as a safe haven. The selling of the Euro-dollar reached the support level of 1.0122 before settling around the 1.0170 level in the beginning of trading today, Thursday.

What is adding to the euro’s losses in the forex currency market?

Recent indications from the results of economic data from the eurozone, which confirm that the bloc is suffering from recession due to the interruption of crucial Russian energy sources, which may stop the path of raising interest rates by the European Central Bank. On the other hand, the Federal Reserve is indifferent to fears of economic stagnation and is determined to raise US interest rates until containing US inflation, which recorded its highest in 40 years.

It appears that ECB officials have invested billions of Euros in bond purchases to protect Italy and other southern Euro members since activating their first line of defense a month ago to keep speculators at bay. Data released this week indicates a significant use of debt-free funds maturing in its pandemic program portfolio, indicating the use of a tool crafted by policy makers as an initial response to any market turmoil.

The statistics, available on a two-month-only basis, show net holdings of German, French and Dutch bonds fell by 18.9 billion euros ($19.3 billion) through July. Net purchases of debt from Italy, Spain, Portugal, and Greece amounted to 17.3 billion euros. The figures are the first hard data to reveal the European Central Bank’s intervention in the debt markets after the explosion in bond yields in June forced President Christine Lagarde to hold an emergency meeting where officials agreed on the need to respond.

As an initial step, policymakers agreed to be flexible in reinvesting upcoming paybacks into the €1.66 trillion pandemic-era asset purchase program. To regulate bond purchases, they divided the eurozone into three categories: donors including Germany, France and the Netherlands, recipients from Italy, Greece, Spain and Portugal, and so-called neutrals.

Lagarde described this resilience as the ECB’s first line of defense against market volatility that threatens the transmission of monetary policy, with the newly created debt-buying tool in the background in case bolder interventions become necessary. Italy has been the focus of investor interest since before the collapse of Italian Prime Minister Mario Draghi’s government last month and elections were put on the agenda in late September.

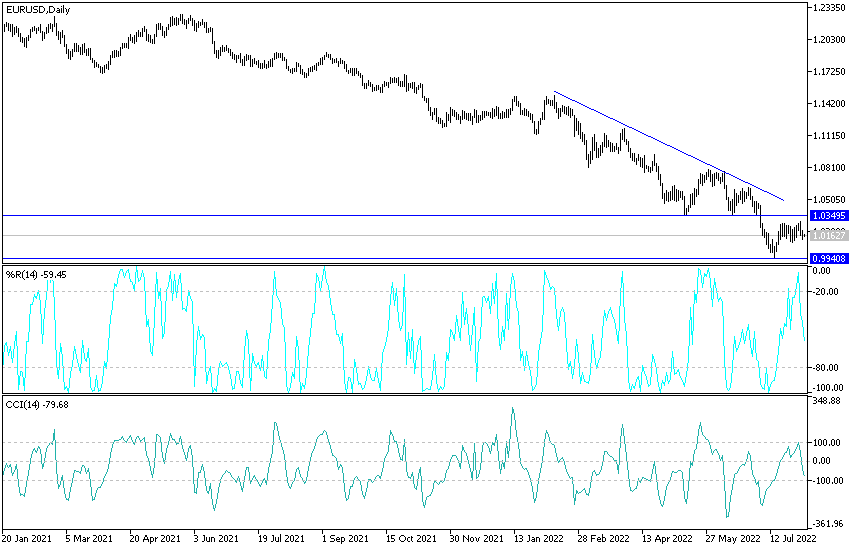

Technical analysis of the EURUSD:

EUR/USD is moving within a range, with support around 1.0120 and resistance at 1.0270. The price attempted to break above the top but has since fallen back inside the pattern. The pair is approaching the bottom of the range, which may once again settle as a floor. In the near term the 100 SMA is above the 200 SMA to indicate that there is a chance to go up but lacks strong momentum.

Stochastic is also moving higher to show that buyers are in control. The oscillator has room to rise before reaching an overbought area to reflect fatigue among buyers, so another bounce to resistance may follow. EUR/USD fell below the dynamic inflection points at the moving averages as an early sign of selling pressure. A break below the support level could lead to a decline that is the same height as the consolidation pattern or 150 pips.

Ready to trade our daily Forex analysis? We’ve made a list of the best Forex brokers worth trading with.

[ad_2]